RiskOps

Beyond Financial Crime

Real-TimeCustomer Trust

RiskOps masters identity, real-time data, and collaboration across teams for pinpoint risk

certainty, reduced internal workloads and greater customer trust.

Embedded Fincrime Protection

Safeguarding Digital Lives

Real-TimeCustomer Trust

RiskOps operationalizes risk management by standardizing principles and processes to create

customer-centric workflows that more accurately uncover hidden criminal activity. At the same

time customer experience is improved to foster loyalty across connected services and applications.

Real-time

Ensure financial crime is mitigated swiftly using the industry’s most scalable and highest speed architecture.

Connected

Natively connect teams to deliver a coherent financial crime approach. Less platforms to maintain, less training, better decision-making.

Identity

Know Your User across all channels and touchpoints to create optimal, secure customer experiences.

The Need for RiskOps

The Feedzai RiskOps Platform

Streamline All CustomerRisk Processes

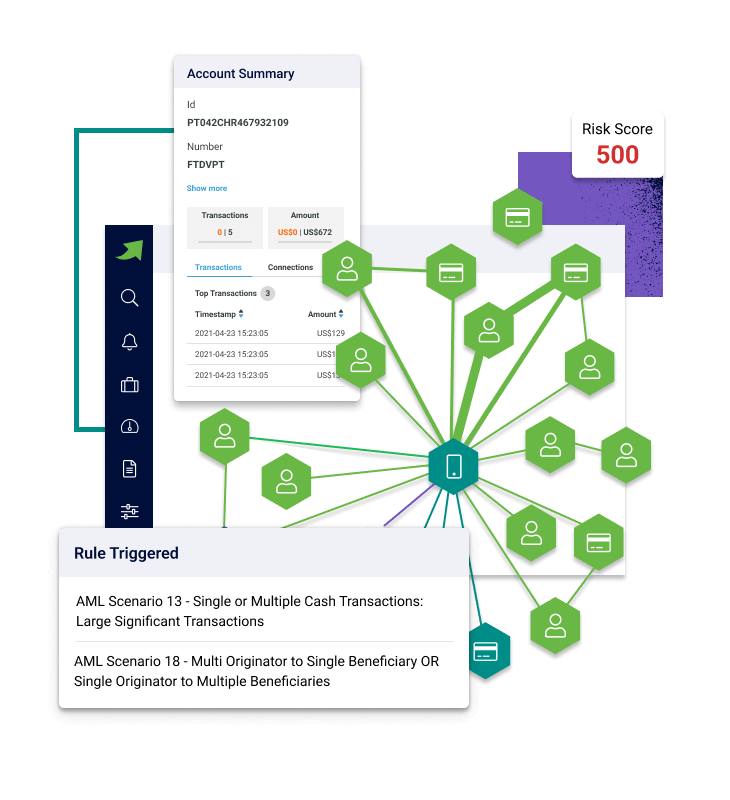

All functions share the same consistent view of data, profiles, and customer activity to ensure that each decision is made with certainty. For example, transactional screening (fraud and sanctions) combines with behavioral screening (AML/CTF and KYC/Customer Due Diligence).

Every use case of Fraud and AML on a single platform

- Account Opening

- Account Takeover

- AML

- KYC/Customer Due Diligence

- Transaction Fraud

- Watchlist Screening

Comprehensive

Every phase of the customer journey is managed on a single platform avoiding data redundancy, saving costs, and simplifying business clarity.

Visual Link Analysis

Uncover hidden links in financial crime activities with AI-powered visual link analysis. Enable analysts to investigate and stop attacks with greater efficiency and accuracy.

Whitebox Explanations

Provide analysts with human-readable explanations to easily understand the underlying logic of machine learning decisions. Improve transparency and explainability for analysts, managers, and regulators.

Collaborative

A single, collaborative experience for all teams to access the data they need in one place, without any silos. No more wasting time adapting insights or best practices across departments.

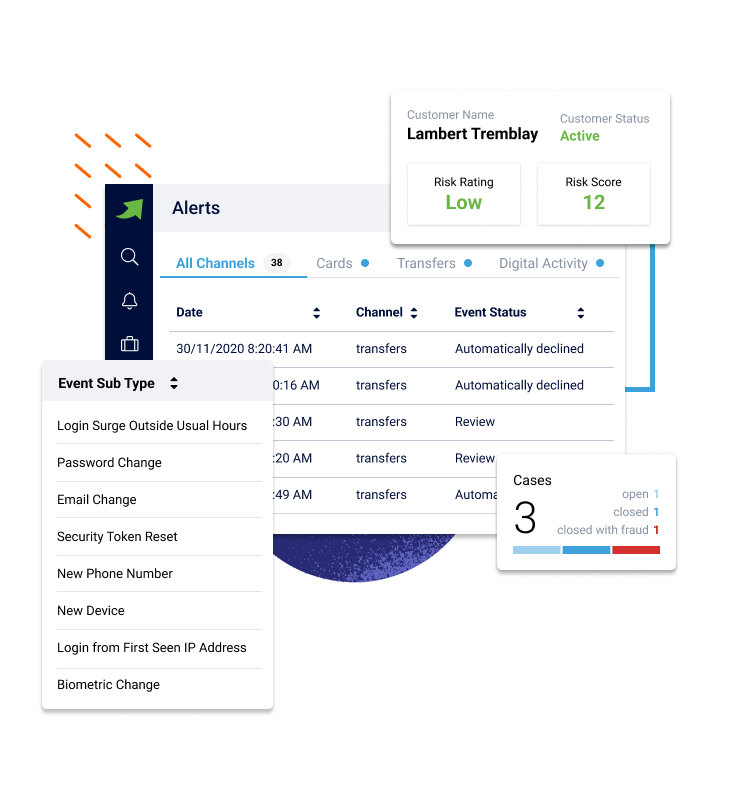

Omnichannel Case Manager

Unify risk operations across channels to enhance detection strategies across business lines and use cases. Action alerts faster, with greater confidence, and aligned with standard workflows. Increase triage and investigator effectiveness with an intuitive user interface.

Actionable Insights

Intelligent dashboards and reporting tools that drive continuous business and operational performance improvements. Achieve real customer intelligence to identify new threats and reveal new business opportunities.

Identity

Compare an individual customer’s current and previous behavior for faster identification and alerting of activity that falls outside of their unique patterns. No more relying on group behaviors that too often overlook genuinely suspicious transactions.

Behavior + Transactions = Trust

Feedzai tracks and updates numerous profile traits from device and behavior to payments and account modifications. Real-time and historical behaviors can be created for any data element, including account, IP, address, etc.

Profiling You Control

Understand customers at a multidimensional level to better identify relevant thresholds for any given scenario. Continually innovate to easily adapt and tune tolerances according to your risk appetite – with or without our involvement.

AI and Machine Learning

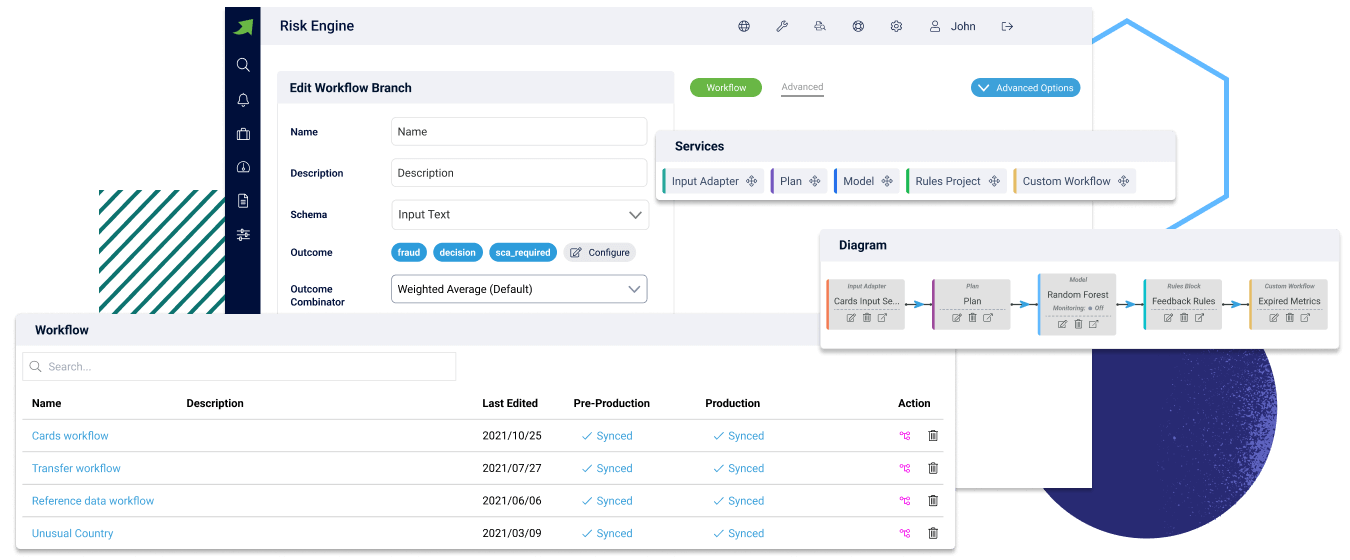

Frictionless Workflows forData Scientists

A winning combination for the future of financial crime prevention: numerous use-case specific patents; recognised as best-in-class for Fraud and AML by Aite and as one of the most successful AI companies by Forbes.

Interested in pushing the boundaries of Fincrime Prevention?

Find out the latest from our Research Labs.

Deploy Models in Days, Not Weeks

Intelligent automation of the normally tedious parts of the data science workflow such as feature engineering and feature and model selection, and increase job satisfaction and retention for data scientists by allowing them to focus on the important parts of their job.

Bring-Your-Own Models

Use standard APIs to easily import 3rd party models into our OpenML Engine, an all-in-one tool for data scientists. Leverage Feedzai’s market-leading features and insights developed over years of fighting financial crime.

Fairness and Transparency

Core to the principles of Feedzai and RiskOps is to treat all customers as individuals. Our AI addresses this by a specific algorithm that automatically monitors fairness against accuracy. This provides low-cost bias reduction and mitigates discrimination.

Why Choose Feedzai

Building a Better way to Transact in Trust

Real-TimeCustomer Trust

Feedzai built the world’s first RiskOps platform specifically engineered and patented to combat financial crime.

Our customers spend less time thinking about risk and more time growing their business.

RiskOps combines a unified approach to financial crime with the single platform to support it. It operationalizes risk

management to open up revenue opportunities and build customer trust.

Built for Speed and Scale

Proven scalability to support high volumes with low latency with some of the largest and most innovative payment companies, banks, and fintechs. Able to crunch enormous amounts of data from multiple customer touchpoints in real time.

Local Experience, Global Footprint

Operating across five continents, we’ll help you launch new products, payment types, or channels across geographies. We understand the challenges that come with fast-changing regulatory landscapes and can guide you through the process.

Relentless, Continuous Improvement

Averaging over ten patents per year, we continuously invest in novel methods to increase fraud detection, reduce losses, and build customer trust. Our award-winning algorithms are recognized for innovation award in financial crime prevention.