Suspicious activity reporting is critical to anti-money laundering (AML) compliance. But as any compliance professional can attest, the SAR filing process can be extremely complicated, time-consuming, and error-prone. But Feedzai’s SAR Manager – available through our AML Transaction Monitoring solution – is making the SAR filing process more seamless and effective at stopping financial crime.

The Top 3 SAR Filing Pain Points

Financial institutions file suspicious activity reports (SARs) with regulatory bodies whenever suspicious transactions are flagged. This includes agencies like the Financial Crimes Enforcement Network (FinCEN) in the United States, BAFIN in Germany, TRACFIN in France, COAF in Brazil, and Bank Negara Malaysia in Malaysia.

What makes the SAR filing process such a minefield? Let’s review.

1. SAR Filing is a Highly Manual and Labor-intensive Process

Banks and financial institutions are required to file SARs whenever a transaction is suspected of being tied to illegal activity. Analysts must collect relevant evidence, including transaction details and adverse news, and manually attach them to the SAR. This can be highly time-consuming for analysts.

2. The SAR Process is Highly Error-Prone

SAR reporting also requires manually entering personal information like names, addresses, and dates of birth into SARs forms. Any information entered inaccurately can compromise the SAR’s accuracy and hamper any relevant investigation.

3. It’s Important to Explain Your Decisions

Filing a SAR is not the end of the story. Regulators will want to understand the decision-making process. Compliance professionals must be able to produce an audit trail of how an analyst reached the decision outlined in the SAR. Many organizations use a Maker-Checker process or a Four-Eye check. In this process, a second person, usually a manager, reviews and verifies the completeness and quality of the information before a SAR is submitted.

4. Dependency on Vendors

Rules-based systems are common for AML transaction monitoring, but many systems create a high rate of false positives. Banks need to be agile in adjusting and tuning rules to get productive alerts and effectively respond to the latest financial crime patterns. However, some transaction monitoring systems are rigid and aren’t self-serviceable – forcing banks to rely on their vendor to adjust the rules when necessary. Further delays occur when banks and financial institutions don’t have a self-service option for transaction monitoring, clogging up their alert queues with overwhelming false positives and impacting their ability to report suspicious activity effectively.

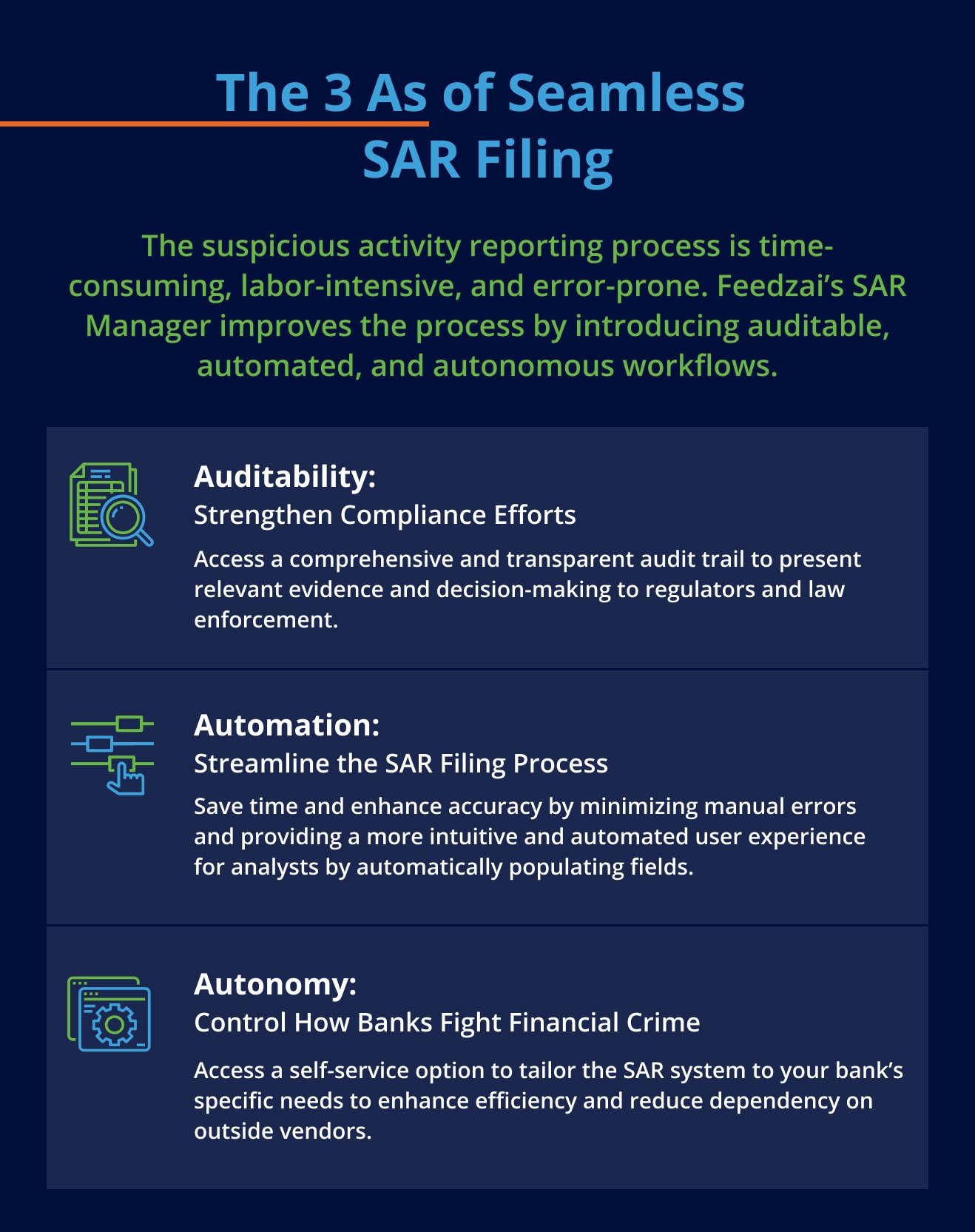

The 3 As of Seamless SAR Reporting

Feedzai’s SAR Manager upgrades the conventional SAR filing process by offering banks a self-service option. SAR Manager improves the traditional reporting process by introducing three As into the workflow: auditable, automation, and autonomy.

Auditability: Strengthening Compliance Efforts

Maintaining a comprehensive audit trail is essential in suspicious activity reporting. SAR Manager provides transparency in all updates and decisions made in the system. This level of audibility ensures that banks have all the necessary evidence to explain their decision-making process to regulators and law enforcement agencies. Additionally, SAR Manager includes a SAR activity log, which records every action taken, such as the creation and updates of SARs, along with date and time stamps. This feature simplifies compliance efforts and reinforces transparency.

Automation: Streamlining the SAR Reporting Process

SAR Manager saves time and enhances accuracy by minimizing manual errors. It also provides a more intuitive and automated user experience for analysts. The system automatically populates entity details and guides analysts through creating suspicious activity reports. Analysts gain access to dynamic form building and are prompted to fill out relevant information, ensuring a more streamlined and error-free process.

Autonomy: Putting Control in the Hands of Banks

Further upstream, Feedzai’s AML Transaction Monitoring solution has self-service rules, allowing banks to better manage their risk strategy and rules performance. Once an analyst determines that a suspicious activity report is warranted, they’re able to utilize the integrated SAR Manager within the same user interface. One key advantage of SAR Manager is the ability it provides to banks to configure roles and permissions for different analysts and managers. This self-service option allows banks to tailor the system according to their specific needs, creating distinct roles such as Level 1 analysts, Level 2 analysts, and managers. By granting banks the tools to configure these roles internally, SAR Manager eliminates the need to rely on external vendors for making changes, thereby enhancing efficiency and reducing dependency.

How Feedzai’s SAR Manager Works

SAR Manager’s true strength lies in its ability to integrate seamlessly with other anti-money laundering tools. It provides a consolidated platform that houses all the necessary evidence and data required for SAR submissions. From Know Your Customer (KYC) and Customer Due Diligence (CDD) to customer and payment screening, SAR Manager offers a comprehensive suite of AML solutions. This eliminates the need for banks to rely on multiple resources, streamlining the entire reporting process and increasing efficiency.

Here’s how it works in operation:

SAR Creation

Banks gain access to a step-by-step guided flow to produce a SAR, structured dynamically according to their local jurisdiction.

Maker-Checker Process

The solution includes a process to enforce a four-eye check. The investigator will create the SAR (the “Maker”) and submit it for approval to their manager (the “Checker”). Usually, the Bank Secrecy Act (BSA) Officer or Money Laundering Reporting Officer (MLRO) approves or rejects the SAR.

Flexible Roles and Permissions

SAR Manager includes configurable role-based access control of a user role for the SAR Manager component that allows permissions to be assigned accordingly. Roles can be assigned based on the following:

- L1 Analysts

- L2 Analysts

- QA Analysts

- Managers

- MLROs

SAR e-Filing

The system automatically generates the XML file aligned with the regulator-specific format for the bank’s preferred jurisdiction. XML files are then made available to be downloaded by the user.

SAR Manager simplifies the SAR reporting process, empowering banks with greater autonomy, automation, and audibility. By putting control back into the hands of analysts and managers, streamlining the filing process, and enhancing compliance efforts, SAR Manager offers an invaluable solution for financial institutions. With the ability to configure roles, automate form filling, and maintain a comprehensive audit trail, banks can optimize their SAR reporting capabilities and improve overall efficiency in combating financial crime.

Share this article:

Tiffany Ha

Tiffany Ha is a Sr. Product Marketing Manager at Feedzai. She has spent the last eight years in the fraud and financial crime prevention space. Financial crime trends and tactics are always evolving, so the accompanying technology must stay ahead of the curve. She loves connecting the dots between technology and market challenges to help financial institutions achieve their goals.

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…