Skyrocketing unemployment brought on by the Coronavirus pandemic helps explain why money mule scams are on the rise. In the U.S., roughly 30 million people filed for unemployment over six weeks. Some analysts predict the final numbers for April could reveal unemployment rates between 16% – 20%. For reference, that would be the highest since the Great Depression when it reached 25%.

The United Kingdom doesn’t report unemployment in the same way, but seven out of ten UK firms have reduced employees’ income. The British Chamber of Commerce’s weekly Covid-19 tracker poll revealed that 71% of companies furloughed at least some staff this week, up from 66% last week. What this means is that globally there are a large number of people who feel desperate.

And as the adage goes, desperate times create desperate measures: enter the money mule scam. Based on the industry intelligence we have, banks are already seeing a rise in money mule activity.

What is a money mule?

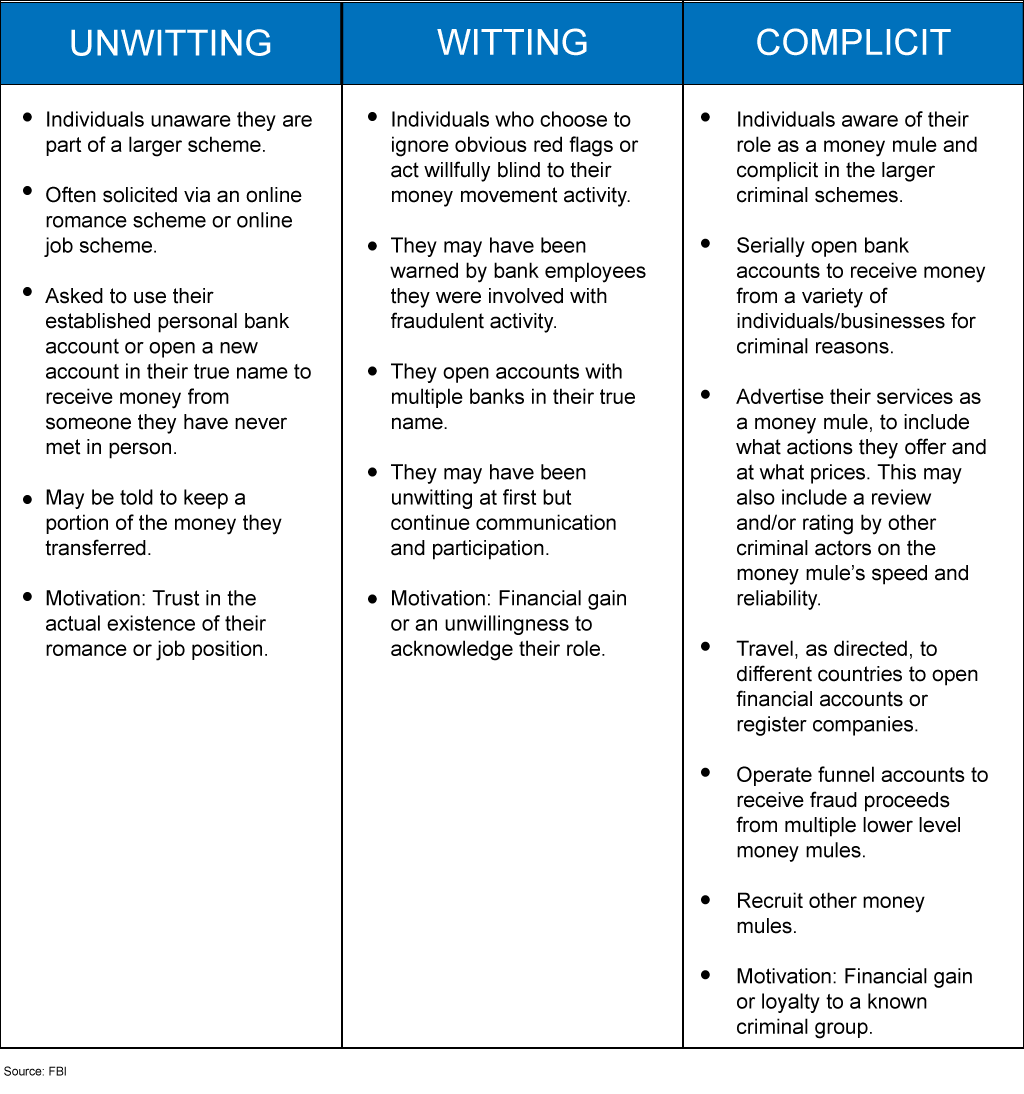

Before we go any further, let’s be certain we’re using the same definition for money mule: a person who transfers money on behalf of or at the behest of someone else. But not all money mules are created equal. There are typically three categories of money mules. They are:

Covid-19 Money Mule Scams

Covid-19 Money Mule Scams

I’d argue that the extraordinary circumstances created by COVID-19 have made an almost hybrid unwitting/witting mule. These people potentially start unwitting but become suspicious. Something doesn’t quite sit right with them, but they don’t want to know the truth. It becomes a case of don’t ask, don’t tell. And in this way, the barrier to participation decreases, and the willingness increases. This is especially true if the money earned from mule rings provides for basic necessities. Like I said, desperate times.

All that is great news for criminals who are masters at exploiting circumstances and market innovations. Right now, they’re seizing opportunities presented by three factors:

- COVID-19. Criminals prey on people’s sympathies with COVID-19. For example, they’ll pretend to be a citizen stuck abroad who needs you to send or receive money to help his grandfather battling COVID-19.

- Unemployment. Criminals exploit economic fears by creating fake websites advertising jobs that are too good to be true. A recent example would be the fraudulent website Vasty Health Care Foundation that recruited people to supposedly work for a COVID-19 charity, which was actually an illegal mule recruiting site.

- Faster payments. Faster and real-time payments enable the swift movement of money through multiple accounts, making it difficult to determine the source of the funds. Criminals like to move money multiple times through the network to reduce their risks and to create a convoluted trail that is hard to follow.

Conventional mule management systems aren’t enough

Conventional mule management practices include monitoring, reactive remediation controls, and preventative controls. Let’s look at each of these briefly.

- Monitoring. Monitoring identifies suspected mule accounts, and it is a critical aspect of any anti-money laundering (AML) system, but it doesn’t stop mule activity.

- Reactive remediation controls. These are the processes for how banks shut down accounts they’ve identified as mule accounts. While this is important, it is just the bare minimum for AML programs.

- Preventative controls. This process blocks known criminals from opening or maintaining accounts. Its effect on money mules is moderate, but it won’t impact our hybrid COVID-19 unwitting mules or any unwitting mules for that matter.

4 Actions to Stop Money Mules

If conventional mule management systems aren’t enough, what can banks do to stop the rise in money mule scams brought on by COVID-19 opportunists? Here are four actions to take today.

- Consider both non-monetary and monetary data. Look at common devices, addresses, etc., along with transaction amounts.

- Holistic scoring. The basic premise here is to provide mule scoring at different stages of the life cycle. For example, combine application mule scoring with mule scoring done every time the customer engages with new products, and add transaction mule scoring as well. Holistic scoring augments the initial mule score and creates a mule history over time.

- Combine inbound and outbound payments monitoring. Looking at either of these payments in isolation is interesting, but looking at them together is impactful. To be effective, include movement of payments between account rings.

- Complete behavioral profiling. Combine traditional behavioral data, such as session data with account behavior changes and session behavior changes. Are they spending more than they usually do? Are they moving more money through than they normally do? Are they increasing the number of monthly payees they have? Do they typically cycle $5,000 a month through their account, and is it suddenly $20,000? That’s the behavior we think about in one context. And then there’s the behavior of logging on twenty times a day rather than three times a day. Create behavioral profiles that look at all of these patterns together.

Key Learnings

Criminals are using economic and social conditions created by the COVID-19 pandemic to perpetuate money mule scams, which are, in fact, on the rise. There are three generally accepted types of money mules: unwitting, witting, and complicit. However, the coronavirus pandemic creates a sort of hybrid between unwitting and witting. This person is desperate and is clinging to the adage ignorance is bliss. They are either motivated by helping others during the crisis or by their difficult financial circumstances. Criminals exploit these conditions, along with utilizing faster payments to launder money. Unfortunately, conventional mule management systems have little impact to stop the problem. Instead, look to create thorough and holistic data viewpoints and strategies to develop an effective money mule profile.

Looking for more actionable insights for how to fight financial crime during the coronavirus pandemic? Read Coronavirus Economy: How to Fight Fraud & Friction to Survive.

Share this article:

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…