As if the dreaded Tax Day wasn’t stressful enough, fraudsters can add additional stress for both taxpayers and banks with tax refund fraud scams. That’s why, as millions of US taxpayers break out their green visors, sort through a shoebox full of receipts, and dust off their math skills, banks must be hyper-vigilant against criminals’ tax refund fraud tricks.

Why Tax Season is Ripe for Fraud

Tax filing season is an ideal time for criminals to defraud consumers and banks. It’s a time when people are often under a great deal of pressure and scrambling to understand complicated tax laws. Most people want to file their tax returns on time and accurately to avoid consequences like an audit (or worse, fines or jail time).

These circumstances give fraudsters two key ingredients they need for tax scams: pressure and confusion. Bad actors can push tax scams to victims who are under pressure to fill out their tax forms correctly and are likely overwhelmed by new tax laws. If taxpayers aren’t careful, they risk trusting the wrong person who contacts them to offer assistance with their tax preparation and filing.

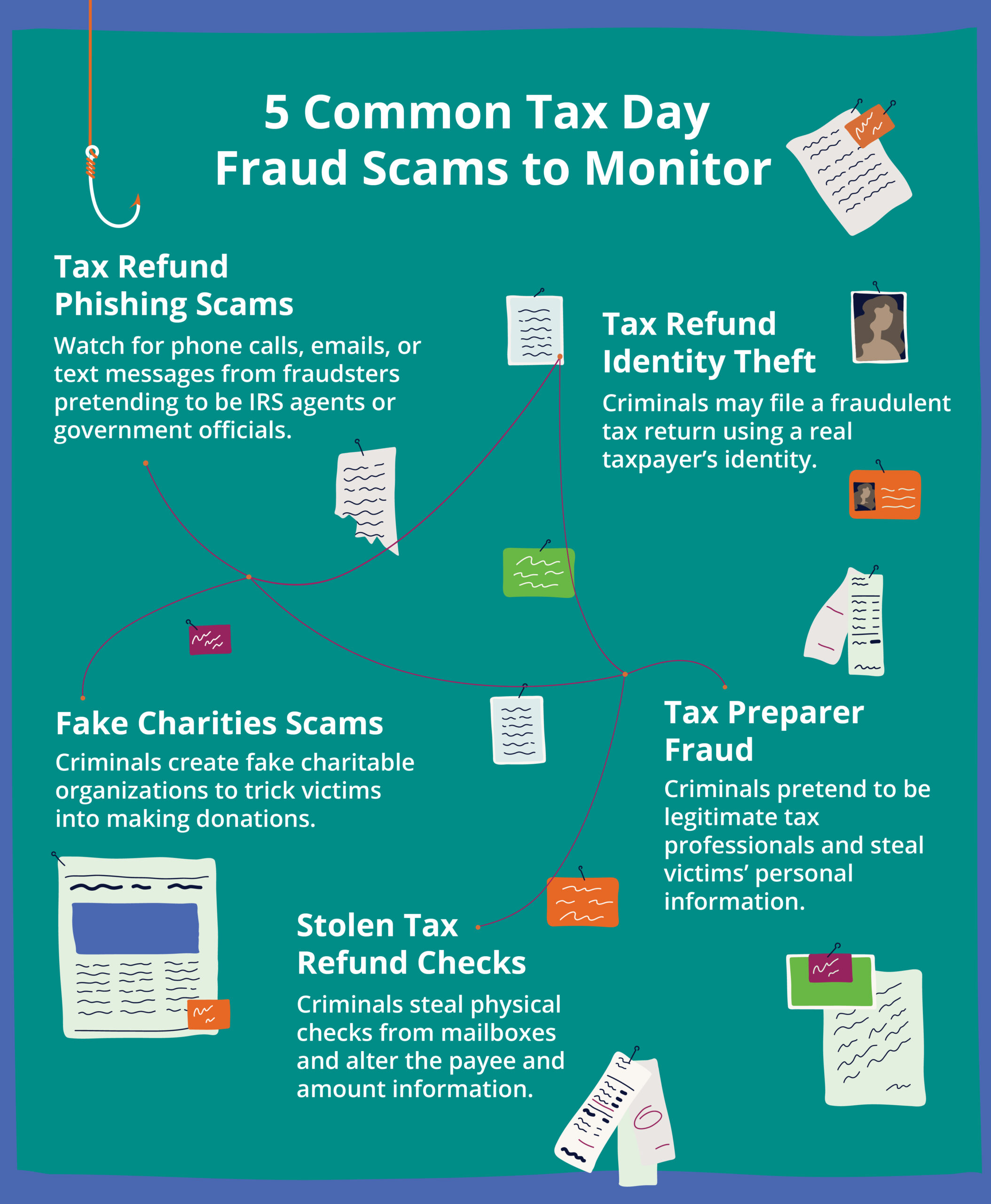

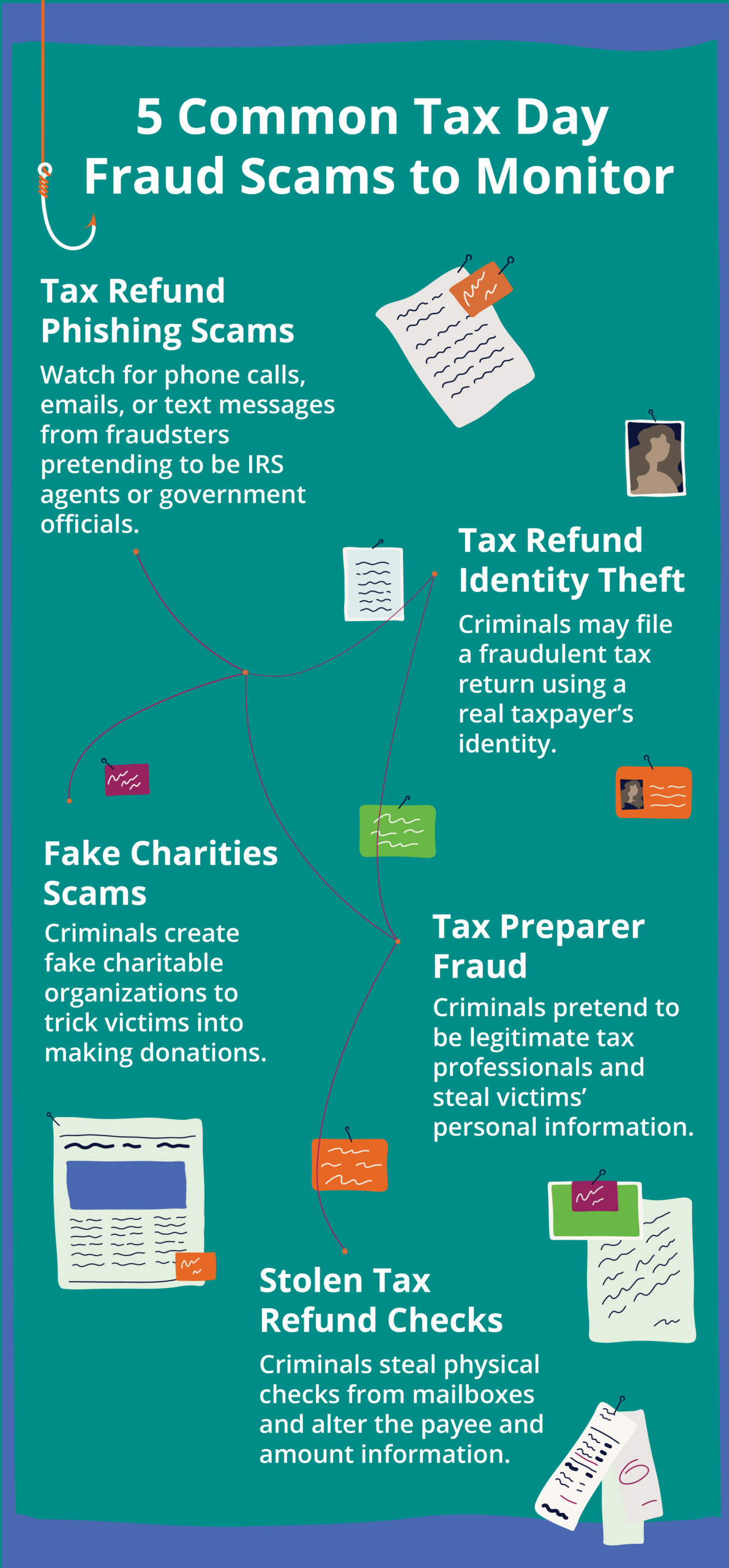

5 Common Tax Refund Fraud Scams

Tax refund fraud can take many forms. It’s important for banks and taxpayers alike to be vigilant against some of the most common types of fraud. This includes

1. Tax Refund Phishing Scams

Phishing, vishing, or smishing attacks get much more specialized when targets are worried about filing their taxes. Bad actors are fully aware of how stressful this time of year is and have learned to focus their phishing messages to play to victims’ insecurities. Some fraudsters will make phone calls pretending to be an agent from the Internal Revenue Service or another government agency. If the deception is successful, the fraudsters may convince victims to share personal information like their bank account, social security number, phone number, or address with a criminal.

2. Tax Refund Identity Theft

Years of data breaches have exposed large volumes of customers’ personal information, including social security numbers, home address information, phone numbers, emails, and more. Fraudsters and identity thieves can obtain stolen information on the dark web and file fraudulent claims using a taxpayer’s real name in the hope of snatching their tax refunds.

3. Tax Preparer Fraud

Taxpayers should also be mindful of criminals who pretend to be legitimate tax preparers. If they are successful, fraudsters may convince their victims to meet them in person at a fake office or consult with them online. Victims believe they are getting honest services, but they are really handing over personal information and money to criminals. At the same time, taxpayers should watch for legitimate but dishonest tax preparers who promise generous tax refunds or charge outrageous fees for their services.

4. Fake Charities Scams

Some US taxpayers try to lower their tax bill by making donations to charities. Criminals take this as an opportunity to create fake charitable organizations and promising write-offs. They may even create a convincing website and study their target’s interests on social media. From there, they can create a fake charity that will play to their target’s specific values like humanitarian aid, climate change, or education. Victims then send money but learn too late that the organization was a fake.

5. Stolen Tax Refund Checks

While the other forms of tax refund fraud listed here involve manipulation or deception, this crime simply involves old-fashioned physical theft. Recent data from FinCEN found that check fraud rose 84% last year compared to the previous year. Criminals steal refund checks out of mailboxes and alter the payee and amount information.

How Banks Can Protect Customers from Tax Refund Fraud

If customers find themselves victims of tax refund fraud, they will likely expect their banks to make them whole again. While banks are not required to reimburse customers for scams, those that help their customers avoid or recover from scams can strengthen their customer relationships by demonstrating their commitment to keeping customers safe.

Educate Customers on Different Tax Refund Scams

The most effective way to help customers is to teach them to protect themselves. Banks should launch educational campaigns for tax season that raise awareness of the different types of scams that are common at this time of year. These campaigns should teach customers to watch for suspicious phone calls, text messages, emails, and other communications fraudsters use to contact their victims. This means encouraging customers to use reputable tax preparers and referring them to a trusted tax professional whenever possible.

Encourage Earlier Tax Filing

Panic works in fraudsters’ favor every tax season. If customers wait to file taxes until the last minute, they may find themselves in a frenzied state and risk making a poor decision over who to trust. Banks should encourage customers to file their taxes as early as possible to avoid falling victim to tax refund fraud. This will also help prevent fraudsters from filing fraudulent tax returns in their name.

Monitor for Unusual Bank Account Activity

In addition to educating customers, banks can also look for suspicious activity in their own systems. For example, is a newly-created account receiving a significant amount of deposits? If so, this could indicate that a fraudster is controlling the account. At the same time, banks can monitor if the account holder is trying to move money out rapidly; they may be involved in money mule activity.

Match Tax Refund Names with Bank Accounts

Banks should also check that the name on a tax refund check matches the account holder’s name. Financial institutions can use fuzzy matching logic to determine if a tax refund check issued to the customer is being deposited in the account of the same name. On the other hand, if the name on the check doesn’t match the account holder’s name, that’s a sign of suspicious activity that deserves further investigation.

Tax filing season is already stressful enough. Banks can help their customers from incurring additional stress by protecting them from tax refund scams. Moreover, banks can continuously educate customers about these threats all year. Tax season may only come once a year. But fraudsters are always looking for write-off opportunities.

Share this article:

Sanjay Salomon

Sanjay Salomon is an experienced journalist who has written for WGBH, US News & World Report, and Boston.com. He was a member of The Boston Globe’s Pulitzer Prize-winning team for Breaking News for coverage of the Boston Marathon bombing. Later, he became the Senior Writer at PYMNTS, extensively writing about digital fraud, banking, AML/KYC, cross-border commerce, and numerous other payment-related topics. As a Feedzaian, Sanjay loves storytelling and helping banks and financial institutions keep their customers safe from fraud and scams. He lives in New England with his wife and their two cats.

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…