Credit unions are under increasing pressure to diversify the services they offer in order to meet the expectations of both current and new members. The two cohorts have competing drivers: older generations demand in-person services, such as wealth management planning, while younger generations want newer services, like seamless P2P payments.

These competing demands pose a difficult question for credit unions. Do they focus solely on newer, more modern channels in hopes of attracting new members, or continue to expand their in-person channels to support their existing members?

While many financial institutions, including credit unions, have focused solely on the concept of ‘Digital Transformation,’ and the massive digital channel investments that come with it, they tend to overlook one particular path to a successful digital transformation: omnichannel banking.

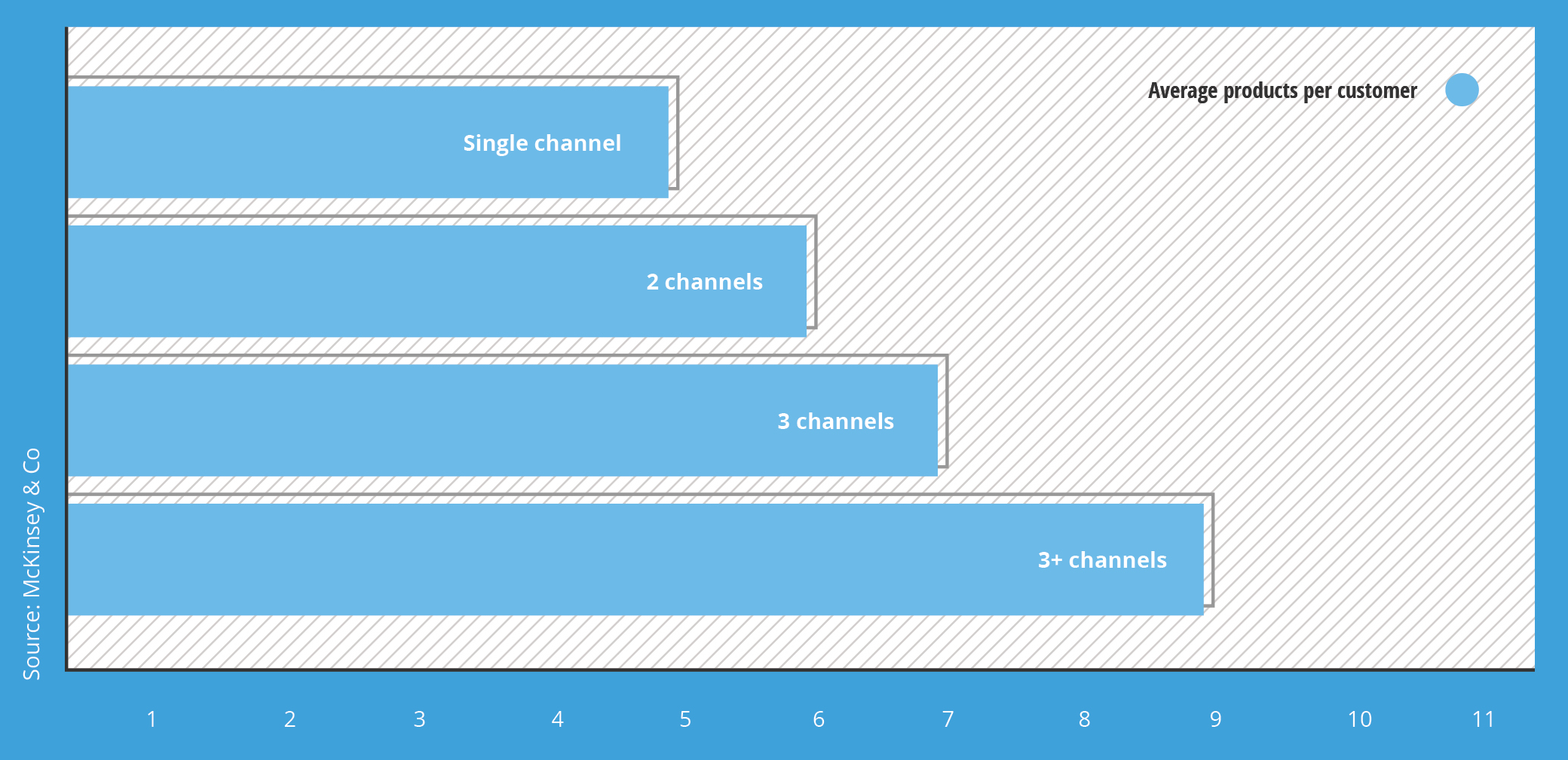

With banking being a long-tailed industry, the ability to continually sell new products during a member’s lifespan is critical for the ongoing success of credit unions. And the research shows that there is a positive relationship between the number of channels a bank or credit union can engage with a customer through, and how many products they end up purchasing.

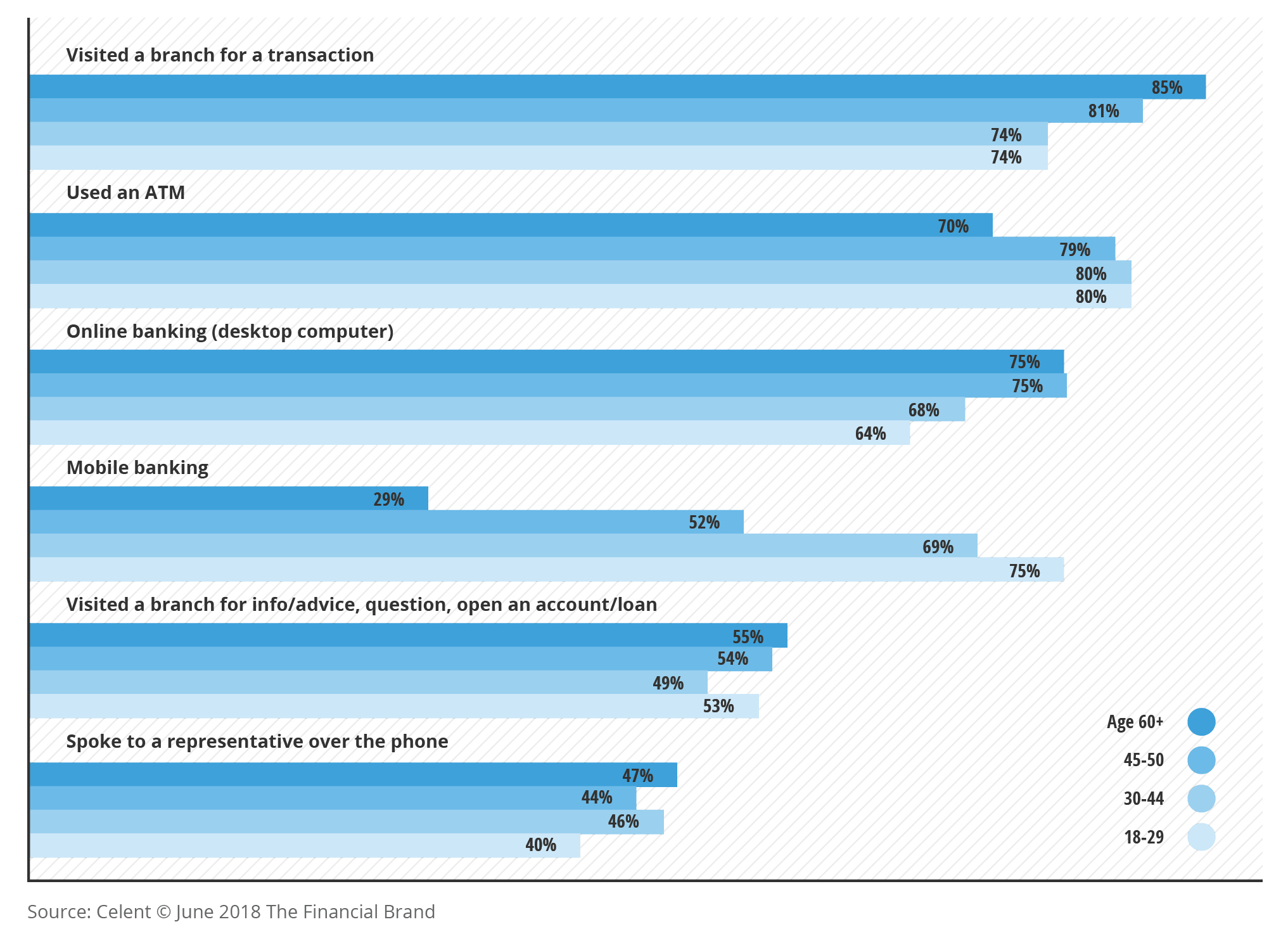

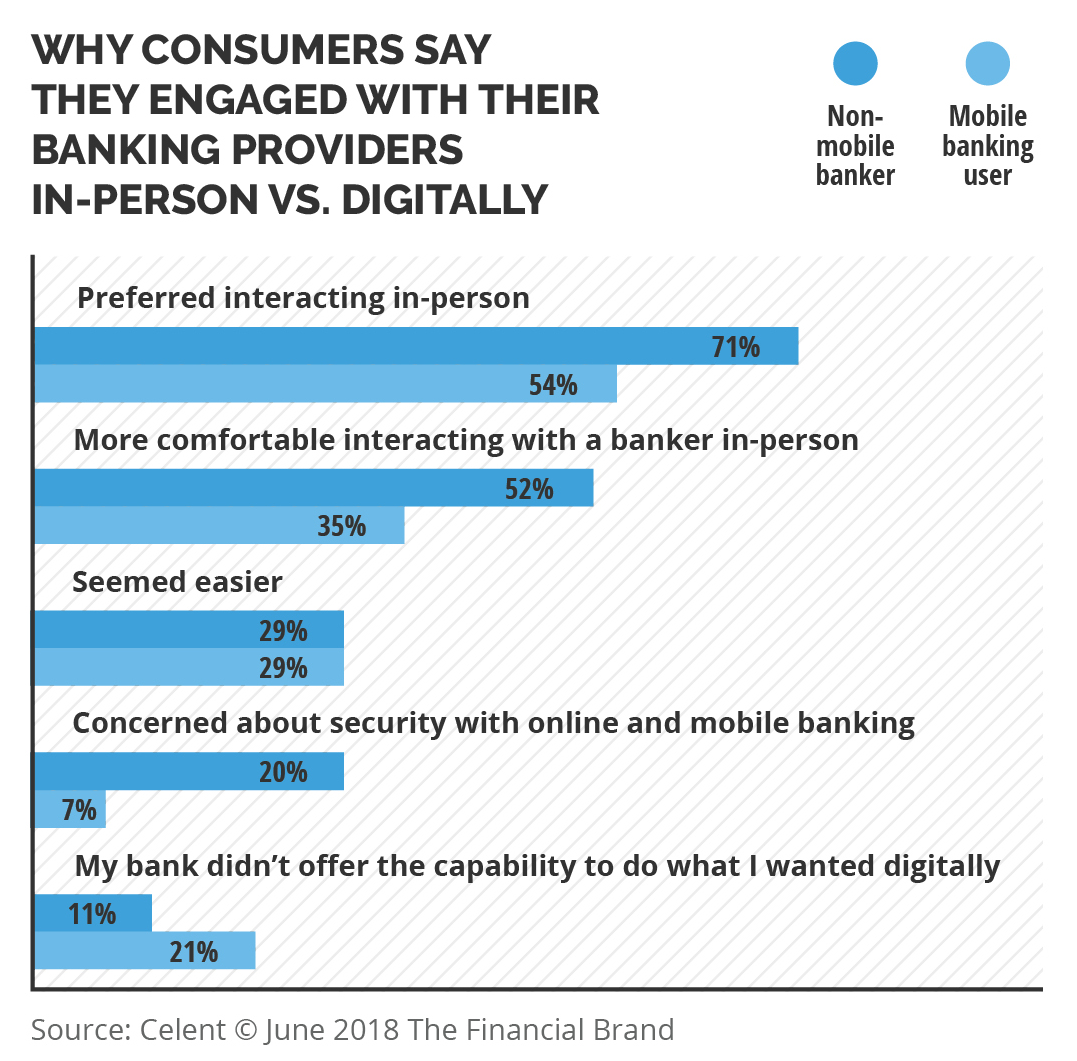

Also, contrary to popular belief, new generations also care a lot about access to traditional channels. While many more 18-29 year olds use mobile banking than previous generations (a whopping 75% compared to 29% of 60+ year olds), their demand for in-person services remains high. 74% of 18-29 year olds have visited a branch for a transaction in the last two years, citing reasons such as they “preferred interacting in-person,” or they felt “more comfortable interacting with a banker in-person.” While the number of 18-29 year olds visiting a branch is less than the 85% of 60+ year olds, it is still well over the majority.

Credit unions face pressure to diversify their products and services to match their members’ expectations. Will embracing an omnichannel strategy enable credit unions to grow safely?

Millennials and older members of Gen Z may have significant demand for new and improved digital services but the importance of brick-and-mortar channels hasn’t diminished. We could postulate endlessly as to why younger generations continue to want to visit branches. One theory is that younger generations still prefer a certain amount of hand-holding as they dip their toes in the traditionally confusing world of banking. Whatever the driver, the sentiment is clear: omnichannel banking is the future of banking.

The Risks of an Omnichannel Strategy for Credit Unions

While an omnichannel strategy comes with a number of benefits, such as improving credit unions’ member experience and growth, it also comes with its own set of risks. For credit unions to continue to grow and maximize member acquisition, these core risks must be mitigated.

More Channels Means More Risk Exposure

While new channels mean more opportunities for member interactions, it also makes monitoring channel health and member behavior more difficult. Even though credit unions may have an understanding of typical behavioral patterns of nefarious actors in some of the channels they currently support, predicting how the same nefarious actors will operate in new channels is next to impossible. For example, a study conducted by Guardian Analytics in 2016, found that a remote check deposit accounted for 72% of all fraud cases conducted via mobile app. Criminals are trained to sniff out these weaknesses, especially on untested channels, and to exploit them.

Financial Criminals Are Getting Smarter

As technology rapidly improves to detect criminal behavior, criminals are quickly adjusting their tactics. Complex schemes, such as cross-channel account takeover (leveraging multiple channels to gain control of a member’s account), have risen out of the battle and can often be difficult to detect due to credit unions’ limited technological capabilities. Criminals know that these complex behavioral patterns expose blind spots in credit unions’, and financial institutions in general, monitoring systems. Therefore the criminals are constantly devising new schemes to con the systems.

Member Trust Is at Risk

Lastly, but most importantly for credit unions, the member trust built over long-term relationships is at risk as credit unions deploy an omnichannel strategy. With major security breaches and online fraud events now a common topic in the mainstream news, many members have come to distrust these services. According to a recent Gartner study, even with basic online services, approximately 18% of consumers forgo them altogether, saying they “don’t fully trust them.” Finding a way to support members who are wary of these new channels, while also continuously building trust to enable new product sales, is critical for future success.

Improved Technology to Balance Expansion and Risk

With the increase in complexity of managing risk comes the need to implement systems and systems architecture in order to properly prepare for increasing risk exposure. Recent trends in financial crime mitigation technology have proven to be effective in both catching complex financial crime schemes and increasing fraud alert review efficiency, such as:

Visualization Engines

Newly developed visualization engines give investigators and data analysts the ability to intuitively visualize behavior, and make faster and more accurate decisions. Historically, transactions are reviewed only when flagged by a risk system and on a one-by-one basis. Rather than viewing a transaction at an individual level, visualization engines enable investigators and data analysts the ability to see the whole picture.

Omnidata-capable Systems

With the need to support new channels comes the need for platforms to be able to ingest any data format. These platforms enable credit unions to ingest data to support any new channel and offer them the flexibility to meet their members’ needs, regardless of what they are.

Self-serviceability

Older systems tend to rely on massive professional services teams, or their own internal IT team, to update their systems to keep up with evolving financial crime. The inclusion of self-serviceability allows the users, both investigators, and fraud analysts, to make updates in real-time, allowing for more dynamic financial crime-fighting.

To read more about how Feedzai powers credit unions as they evolve, follow the link to download our latest Ebook: Powering Credit Unions with AI

Share this article:

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…