We’re battling a silent yet alarming menace – brute force or BIN attacks. BIN attacks are a type of fraud where cybercriminals use the first four to eight digits of a debit or credit card number – known as the Bank Identification Numbers or BIN – to guess the rest of the card number, expiration dates, and CVV information.

Think of BIN attacks as a type of digital pickpocket. Instead of “accidentally” bumping into you and stealing your wallet, they steal your credit or debit card number. They employ techniques such as data breaches, phishing attacks, and social engineering in their efforts.

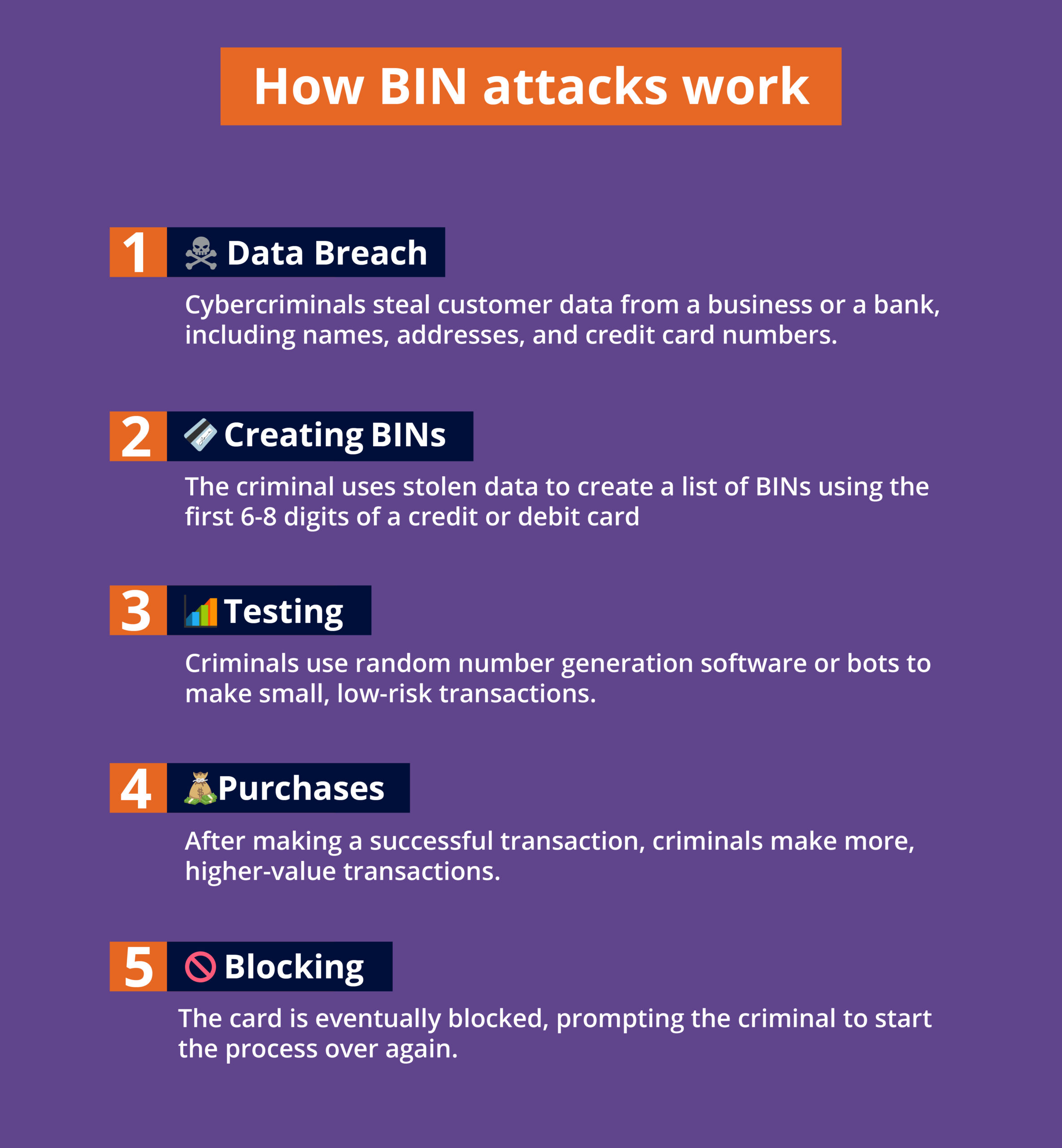

Here’s how a BIN attack works:

- Cybercriminals steal data from a company, such as a store or a bank. This data can include a customer’s name, address, and credit card number.

- The cybercriminals use this stolen data to create a list of potential BINs using the first 6-8 digits of a credit or debit card number.

- Cybercriminals use random number generation software or bots to test the BIN numbers in a process called “carding.” Carding is when criminals make small, low-risk transactions online until they find one that hits.

- Following a successful transaction with an online merchant, they know they have guessed the correct card number and can use it to make more fraudulent transactions of higher value.

- The card is eventually blocked, and the cycle starts again.

The Fallout of BIN Attacks on Merchants

The fallout of a BIN attack on a merchant is not just financial but also reputational. A single instance of credit card fraud can tarnish their credibility, leading to a downturn in customer trust and, subsequently, sales.

The financial burden of refunding fraudulent transactions and possible fees levied by the acquiring bank for processing such transactions further deepens their financial pit.

Moreover, card schemes may enforce fines or penalties and demand the merchant to amp up their security measures. The consequence? Increased chargeback rates due to a higher likelihood of victims filing chargebacks. In the worst-case scenario, persistent BIN attacks may sever the merchant’s ties with card networks, putting their ability to manage fraud risk under scrutiny.

Adding Value: How Acquiring Banks Can Safeguard Merchants

In this scenario, acquiring banks can be the knight in shining armor, equipped with an arsenal of advanced tools and strategies to safeguard merchants and prevent BIN attacks.

By employing real-time transaction monitoring, they can keep a vigilant eye on all transactions, scanning for telltale signs of BIN attacks like multiple low-value “testing” transactions, a spike in transaction attempts with the same first card digits, or other unusual purchase patterns.

Data analytics can further help to unveil fraudulent activity patterns. Acquiring banks can also harness the power of machine learning to sniff out suspicious transactions, thereby preventing BIN attacks in their tracks and safeguarding merchants from staggering losses.

But why stop at surveillance? Acquiring banks can extend their protective umbrella by offering a suite of value-added services:

- Fraud Detection Services: An array of further services, such as self-service fraud management or tailored risk strategies, can be offered. These services can act as a merchant’s personal security guard, identifying and thwarting fraudulent transactions before they cause too much damage.

- Security Consulting Services: Tailored consulting services can help merchants fortify their defenses, lower their fraud risk, and ensure their fortress remains impervious to attacks.

- Education and Training: Empowerment through knowledge can be a merchant’s strongest ally. Training programs can help employees identify fraud signs and adopt preventive measures.

By employing such comprehensive strategies, acquiring banks can champion the cause of merchant protection, minimizing the risks associated with BIN attacks and ensuring the digital world remains a safer place to transact.

Share this article:

Gosia Slominski

Gosia Slominski is a Customer Value and Strategy Lead at Feedzai. She believes that innovative technology is essential to winning the global fight against financial crime, and is the key to convert sound risk management into value for businesses and their consumers.

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…