Card networks’ fraud rate increased 60.5% and the dollar value of each attempted transaction was 5.5% higher than it had been the six months preceding the Coronavirus pandemic. That’s just one of the many insights provided by Feedzai’s Financial Crime Report Q4 2020 edition published today. The report captures Feedzai’s exclusive data from over 4 billion global transactions across all major industries from March 20, 2020, through September 2020. It also includes our own consumer research survey of nearly 2,200 U.S. consumers with bank accounts, highlights major fraud trends and shifts in consumer behavior, and offers financial institutions tips to fight fraud and financial crime.

Surprising consumer debit and credit card behavior

Some findings outlined in the Financial Crime Report matched our expectations, such as a 30% increase in Card Not Present (CNP) transactions. That makes sense given the realities of social distancing and lockdowns. But there are surprises too. For example, while there was a 22% decrease in card-present (CP) transactions compared to Q1, that decrease was mostly due to a steep decline in CP transactions in April. By June, CP transactions recovered despite widespread international social distancing protocols.

34% increase in card cloning fraud rate across industries and regions

Another surprise relates to the type of fraud scams most utilized by fraudsters. Debit and credit card cloning, also known as “skimming,” is when a scammer copies stolen debit or credit card information to a new card. This type of card fraud hasn’t garnered the same kind of media attention as account takeover (ATO) or authorized push payment (APP) fraud, but our data shows that it is the most common type of fraud indicator in both the financial services industry and eCommerce. In fact, there was a 34% increase in card cloning fraud rates across industries and regions.

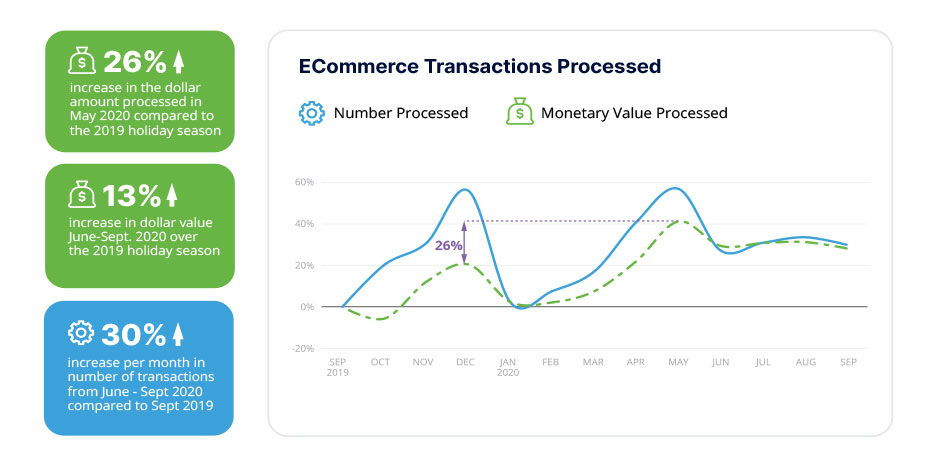

Financial transactions increased, matched last year’s holiday spending

COVID-19 delivered previously unseen digital results: holiday season shopping levels in spring and summer. The dollar amount processed in May 2020 was higher than 2019’s holiday shopping season. What’s more, the dollar amount increases over the previous year’s holiday season were sustained through the summer and early fall. That’s something even Santa can’t deliver.

COVID Cancels Black Friday, hello Cyber Month!

Arguably one of the most significant developments from COVID-19 is the cancellation of the holiday shopping tradition known as Black Friday. Several retailers — including Walmart, Target, and Best Buy — are limiting crowds and extending their deals beyond a single day because of the Coronavirus pandemic. And it’s not just retailers driving this trend. Consumers are opting for Cyber Monday, which will morph into Cyber Month this year as more shopping is done online. It’s a necessary step to both ensure robust retail figures and also meet new COVID-19 realities.

These shifts in holiday shopping patterns are just some of the insights outlined in Feedzai’s Financial Crime report. Download the full report to learn:

- details of the financial crime landscape

- what the acceleration of digital payments means for the holiday shopping season

- fraud rates by industry

- regional fraud rates from the United States

- three ways financial institutions can stop common fraud contributors

The habits of both consumers and fraudsters are changing rapidly because of COVID-19. What’s more, these changes will be in place for the foreseeable future. Download the Financial Crime Report Q4 2020 edition today and learn how financial institutions can meet the moment by delivering seamless digital-first experiences for consumers and leave fraudsters holding lumps of coal for their malicious efforts.

Share this article:

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…