The UK Finance Fraud report results are now live — and they include plenty of valuable insights on how global banks can safeguard themselves against fraud and scam losses.

APP Losses Down While Reports Are Up

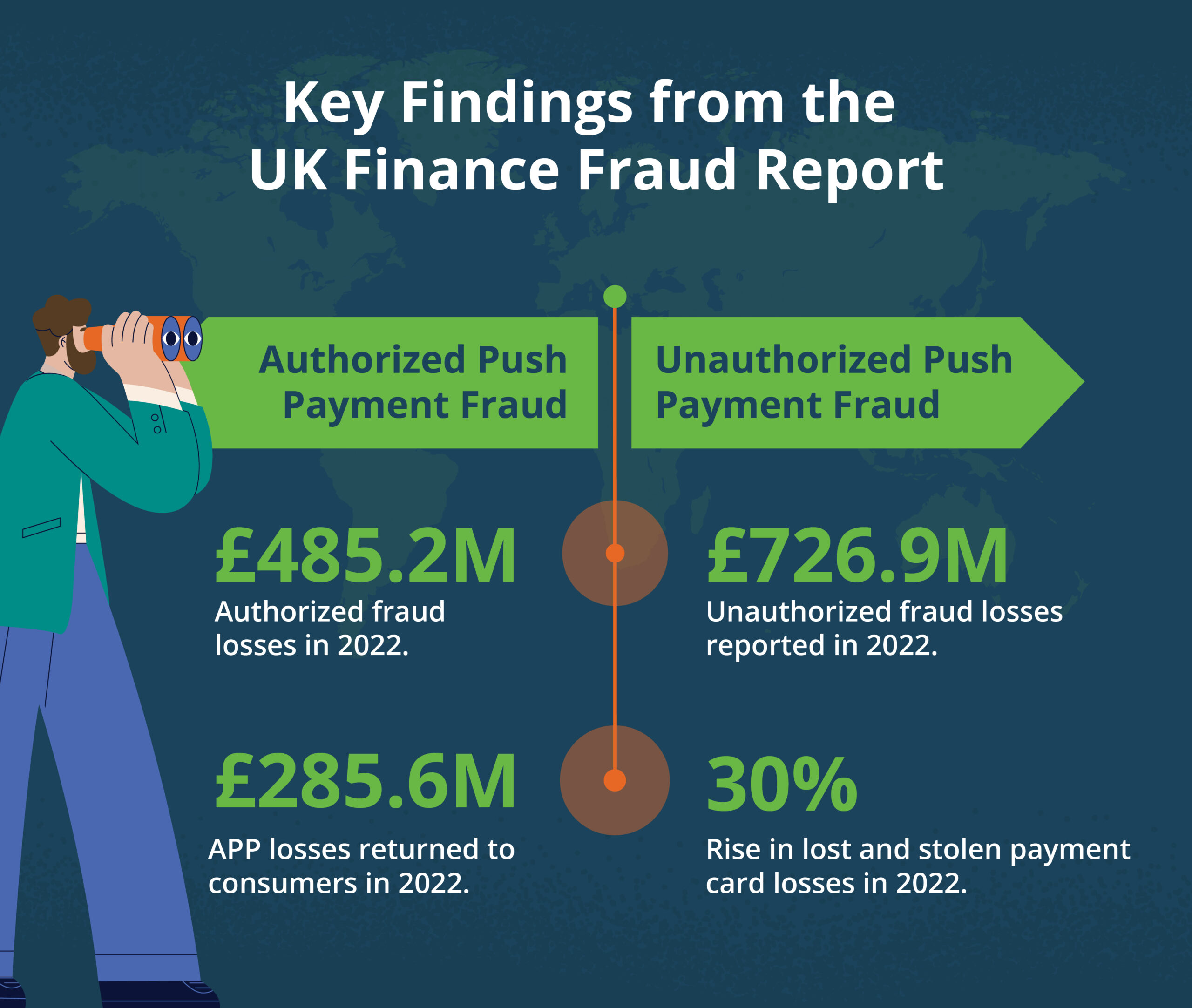

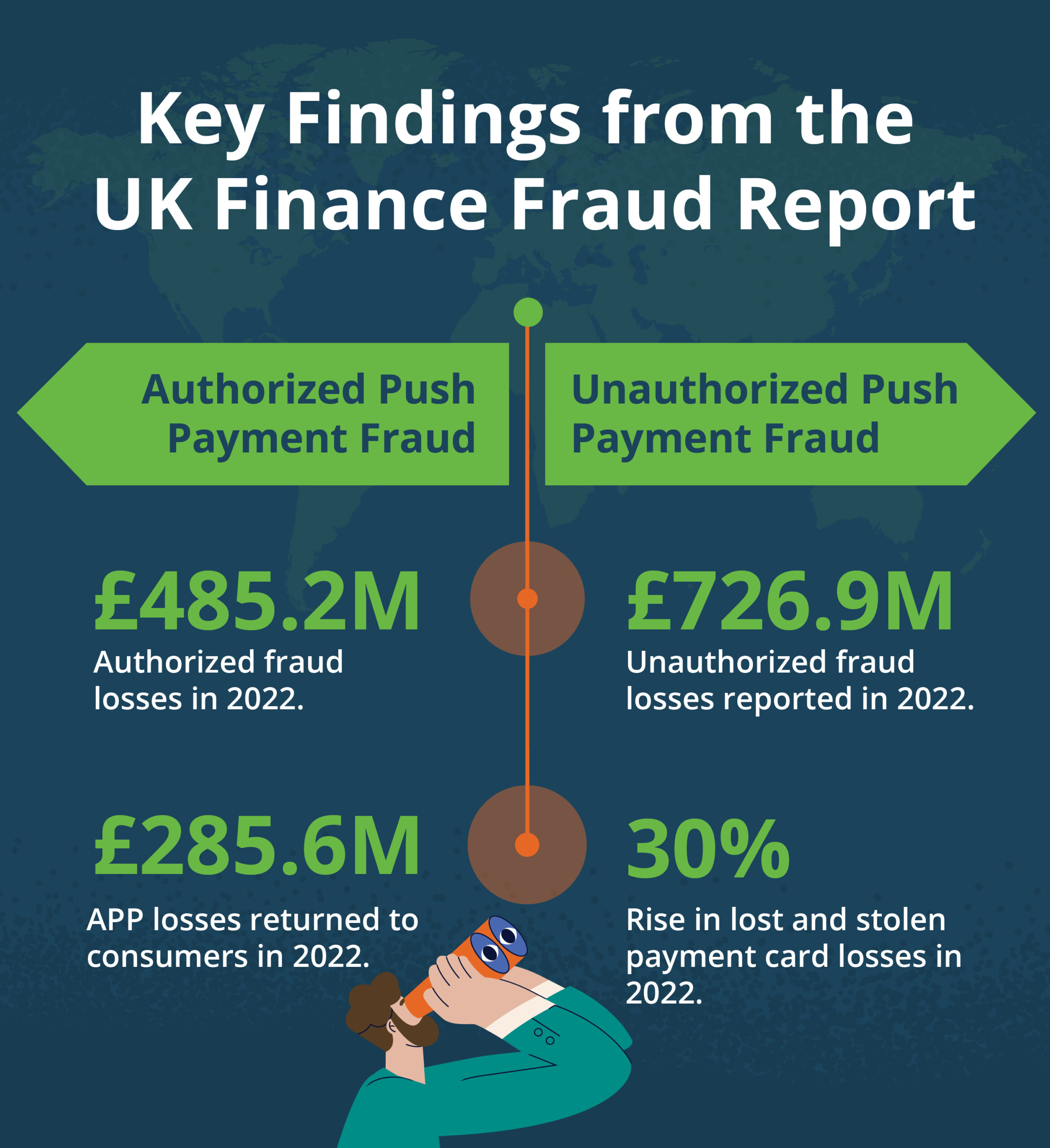

The UK Finance report had both good and bad news regarding the latest authorized push payment (APP) trends.

First, the good news. The value of APP losses dropped by 17% last year compared to the previous year. The bad news: overall reported APP scams increased by 6%. This is likely the result of UK banks being required to reimburse customers who are victims of scams. This rise in reported APP scams, along with a drop in APP losses, demonstrates how banks’ efforts to thwart high-value APP tactics, such as investment scams, are paying off.

Based on these findings, UK banks have been highly successful in addressing APP scams. Across the globe in Australia, however, a different story is unfolding. Australian consumers lost $3.1 billion (AUD) to scammers last year, an 80% increase from the previous year, according to data from the Australian Competition & Consumer Commission (ACCC). ACCC also reported a 16.5% drop in reported scams from 2021. Meanwhile, digital fraud has also risen in Brazil in recent years.

What can global banks learn from the UK’s example? As regulators have shifted liability from consumers to banks, UK banks have stepped up their education efforts. After all, the best way to prevent scams is to prepare customers to protect themselves. While each region will handle liability differently, the UK has helped customers recognize the warning signs of scams and intervene where possible to stop APP losses.

Bank Customers Expect Reimbursement After Scams

The rise in APP reports among UK consumers indicates another important lesson for global banks. Namely, consumers are more likely to report scams because they increasingly expect to get reimbursed for scam losses.

This pattern is a significant shift from only a few years ago when customers were highly unlikely to get reimbursed for scam losses. Customers were simply left to pick up the pieces after a scam with very little help from their banks. Over time, the scam issue increased so significantly that regulators eventually required banks to compensate victims.

Grassroots pressure from consumer advocates had the effect of changing the law. But the momentum has not slowed down. With the Contingent Reimbursement Model (CRM) in place, the knock-on effect is that victims are also more likely to report scam losses in the first place.

Feedzai’s own research supports these findings with 53% of US and UK consumers believing their bank should reimburse them if they are the victim of a scam or a third-party fraud. But banks should also realize how they choose to handle scam reimbursements can carry significant weight in their customer relationships. Feedzai’s research also found 77% of respondents said they will leave their bank if they are not refunded for a scam.

Both Feedzai and UK Finance’s findings present a clear message. The momentum for customers to get reimbursed following a scam is already strong. Today’s customers expect their banks to make them whole again after they have been scammed. Banks that aren’t prepared to step up to their customers’ expectations regarding scam reimbursements risk losing them to other financial institutions that will.

Physical Card Theft Makes a Comeback

While APP fraud losses are down, UK Finance’s report reveals another troubling financial crime trend. Physical card theft is on the rise again.

The uptick in physical card theft is likely the result of more people being out in public following pandemic-related lockdowns of the previous two years. More people walking around public places, dining in restaurants, and taking public transit present criminals with more crimes of opportunity. Criminals can steal physical payment cards and use them to make unauthorized purchases in the legitimate owner’s name. At the same time, contactless payment card fraud also increased. This indicates criminals are paying for goods with stolen payment cards.

Physical card theft is a trend we expect will replicate itself in other global markets. As lockdowns and other restrictions that the world has endured due to COVID-19 are scaled back, fraudsters will likely find plenty of opportunities to steal physical payment cards while legitimate customers try to get back to pre-pandemic “normal” life. Banks worldwide should prepare for an uptick in physical card fraud as fraudsters can have more opportunities for physical theft.

Mobile Banking Channels are Safer, Despite Recent Upticks

The UK Finance Fraud report also delivered interesting findings on consumers’ remote banking channel preferences. This is especially true regarding the breakdown between Internet and mobile banking channels.

Overall, remote banking case volume dropped by 46% in 2022. Broken out by specific channels, reports of fraud from internet banking and telephone banking saw drops of 56% and 33%, respectively. Mobile banking, however, saw a 10% rise in reported fraud.

These statistical increases may paint an unflattering picture of mobile banking. But looking more closely at the number of cases, a different story emerges. More than 12,000 mobile banking fraud cases were reported last year compared to over 32,000 internet banking fraud cases.

In other words, internet banking reports were three times higher than mobile banking reports. Fraudsters are clearly taking a greater interest in mobile banking, most likely because that’s where consumers are increasingly conducting business. But the number of fraud cases reported on internet banking channels far surpasses mobile banking fraud reports. This means mobile banking is a considerably safer banking option than other channels.

But banks worldwide should note that fraudsters are taking a greater interest in mobile banking. As consumers turn to mobile and online technology for banking, these channels will need to be kept secure.

Scam Reimbursement Depends on the Type of Fraud

Banks showed an increased willingness to reimburse customers who fell prey to scams. But not all scams are equally treated in terms of reimbursement. In fact, the likelihood of a victim getting reimbursed is very much dependent on the type of scam used.

Imposter scams involving bad actors pretending to be a bank or police officers are more likely to be reimbursed. The UK Finance Fraud report found a 75% refund rate for these scams. Other types of imposter scams have a refund rate of 63%. Meanwhile, CEO fraud, in which a fraudster pretends to be a CEO and directs employees to approve payments for fake bills or invoices, faces the lowest rate at 23%.

Reimbursement policies will depend on local laws. But imposter scams, especially those involving impersonation of banks and law enforcement, are the most likely to see reimbursement. It, therefore, makes sense for global banks to educate customers about how these types of scams work and prepare for how to avoid falling victim. This includes lessons for customers like “contact your bank before making any high-value transactions.”

The annual UK Finance Fraud report’s fraud findings may be based on local findings, but the lessons have global implications. If international banks learn from these lessons, they can avoid significant scam losses down the line.

Share this article:

Robert Harris

Robert Harris is the Head of Product Marketing at Feedzai and a passionate proponent for fighting fraud and money laundering particularly in financial services. Robert is an accomplished leader in both small and large organizations in identifying opportunities, securing funding, and creatively delivering value in line with project goals. Whether launching new solutions or maximizing value from mature ones has a keen commercial eye and a conviction to both innovate and make prioritization decisions accordingly.

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…