Feedzai is proud to unveil ScamPrevent™, our latest weapon in the ongoing fight against global scams and a significant advancement in scam prevention and fraud detection. How banks can prevent scams will be revolutionized with the addition of industry-leading scam detection. This capability is now available as an enhancement to our RiskOps platform. Financial institutions can add it to their fraud prevention portfolios.

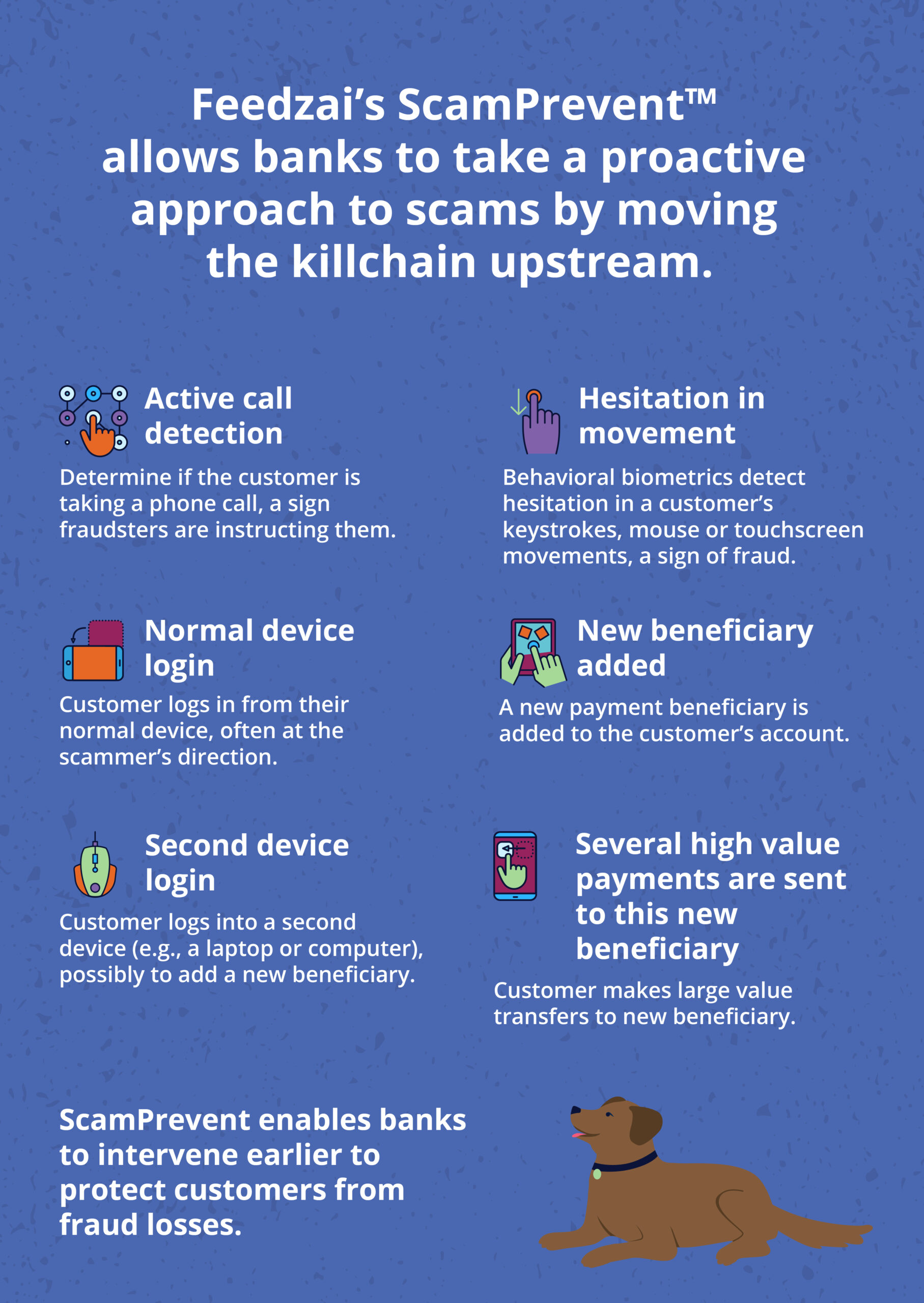

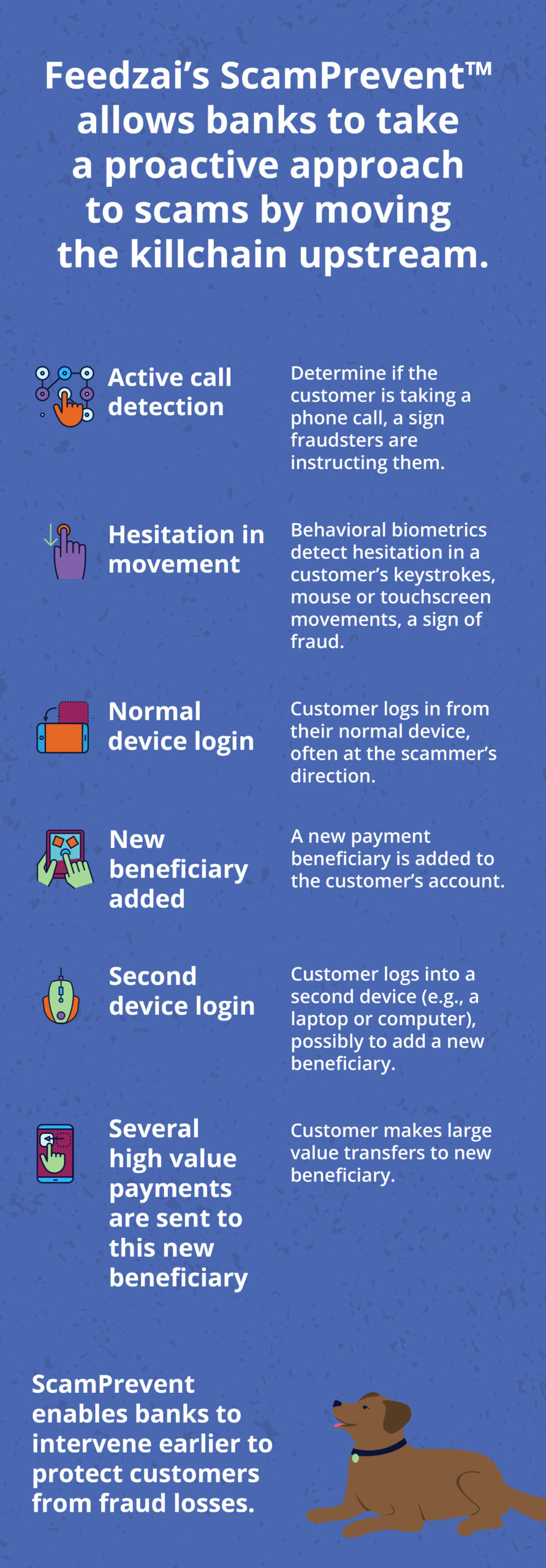

The groundbreaking ScamPrevent features machine learning models that analyze behavioral biometrics and transactions in a complete way to identify signs of coercion or duress. By analyzing risk signals, such as hesitation, active call signals, and anomalous payments, financial institutions can detect suspicious activity and intercept scams before they can inflict harm.

Feedzai’s market-unique all-in-one scams solution represents a significant step forward in global scam prevention efforts.

Global Banks Face a Global Scams Scourge

Criminals employ a wide range of scams to convince legitimate customers to perform their dirty work on their behalf. This includes imposter scams, investment scams, purchase scams, romance scams, and more.

The result has been an explosion of scam typologies. In the US, the Federal Trade Commission reported a 30% increase in scam losses from 2021 to 2023. Meanwhile, recent data from UK Finance finds scam losses in Britain now outpace overall credit card fraud losses. These figures may just capture a fraction of the full scam picture. Data from the Global Anti-Scam Alliance found only 7% of global scams are ever reported.

Scams are poised to surge even further with the rise of faster payment networks such as FedNow in the US. With liability increasingly shifting to banks, a new strategy is needed to prevent scam losses from harming customers.

Why Banks’ Scam Prevention Strategy Falls Short

Many banks rely on point solutions for fraud prevention. However, when it comes to targeting scams these systems are often ill-prepared. That’s because organizations often assume a fraudster is impersonating the customer — as in an account takeover attack. But with scams the fraudsters get legitimate customers to go along with their schemes before they realize something is wrong. As a result, the assumptions made by financial institutions’ control frameworks are often wrong.

3 Key Limitations of Point Solutions

- Systems are siloed: Many banks’ legacy fraud prevention systems are siloed by specific channels, such as mobile banking, the Internet, or call centers. This approach limits these systems’ ability to detect scams across different banking channels and payment platforms. Siloed tools can generate contradicting outcomes, especially when risk is scored in isolation from one another.

- Fraud is measured by behavioral or financial activity – but not both: Some systems consider fraud by looking at a user’s behavioral activity (e.g., their biometric data, app and device usage patterns, malware, and network analysis) or financial activity (e.g., their transaction history by banking channels and platforms). But the systems don’t consider these two activities simultaneously. This limits financial institutions’ capability to detect a scam in progress, especially when a customer’s behavior suddenly changes.

- They’re slow to adapt: Fraudsters are constantly innovating and inventing new approaches to fraud and scams. Once they learn how a rule works, they simply adjust their tactic to avoid triggering it. This leaves banks scrambling to respond. What’s more, many scam victims are reluctant to come forward and report scams. This leaves banks with incomplete scam data.

How Feedzai’s ScamPrevent Enhances Scam Prevention

Each customer has their unique banking behavior. This includes how they interact with their device, as well as the volume and value of payments they execute. Applying AI techniques to capture and analyze these behaviors at scale is crucial to accurately recognize anomalies and prevent scams without impacting the customer experience. The platform uses insights from hundreds of data inputs to build a 360-degree view of the customer’s risk and allows financial institutions to stop scams as they occur – avoiding detrimental monetary loss to both the customer and the bank.

ScamPrevent builds upon our RiskOps approach by enhancing the platform’s ability to identify and intercept scammers. Banks can use these insights to proactively identify scams and intervene before a customer falls victim.

Scam-specific machine learning models

Enhancements to Feedzai’s AI engine based on input and spanning multiple geographies and financial institutions give banks accurate scam detection while reducing false positives. Financial institutions are protected from day one with out-of-the-box rules, models, and metrics designed specifically for scam prevention. Banks can identify warning signs of a scam based on sudden changes in a customer’s behavior and monitor activity across multiple banking channels.

Native behavioral biometrics, device intelligence, and transactional risk scoring

Enhancements to our behavioral biometrics capability enable banks to identify signs a customer is being scammed and intervene earlier in the risk cycle. Aggregated insights for behavior, device, and transaction data give financial institutions full context in one interface to prevent scams. For example, the solution can detect if the customer is on an active phone call while also making an unusually large transaction. This is a red flag that a scammer is coercing the customer to send money.

Inbound payment monitoring

Banks can now monitor both outbound and inbound payments giving financial institutions multiple opportunities to stop a scam by blocking the transfer of funds to an account the scammer controls.

Fraud MO categorization models

The machine learning models can do more than just calculate a risk score. They can also predict the type of fraud in play. Knowing the fraud’s modus operandi (MO) allows banks to create customized fraud prevention strategies tailored to each transaction’s specific risk. This results in better customer experiences – including better treatment for scam victims – and improved operational outcomes.

The easier it gets for customers to make payments, the easier it gets for criminals to commit scams. Banks need to detect and intercept scams before customers lose money in the first place. Feedzai’s ScamPrevent is the only prevention solution equipped with best-practice models, behavioral biometrics, device intelligence, and transactional risk decisioning on one platform.

Share this article:

Pedro Barata

Pedro Barata is the Chief Product Officer at Feedzai, overseeing Product Management, Engineering and Design. He has worked with various global financial services companies and is passionate about building products that deliver tangible outcomes to Feedzai's clients and make the world a safer place.

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…