Data scientists shouldn’t have to choose between a vendor’s models and their preferred options. Here’s how Feedzai’s OpenML Engine enables data scientists to experiment with different model approaches for enhanced fraud prevention.

The amount of progress being made in the machine learning and data science communities is staggering. As new algorithms, approaches and tools proliferate, and as banks hire more and more data scientists, it’s critical to be able to quickly adopt new methods that provide lifts in fighting fraud.

So it’s a growing problem that fraud-fighting systems make it impossible to integrate your preferred modeling approaches and algorithms. Data scientists at banks are left to choose between two bad options. They can work in a singular data science environment dictated by a vendor; or they can keep their own methods, and miss out on the fraud-specific expertise provided by third party platforms or new and emerging frameworks.

Feedzai embraces the data science community, with all its continuous experimentation and innovation. We believe teams should have the flexibility to build models in any language, using any library, and on any platform. Then they should be free to import these approaches to a platform that was purpose-built, from the ground up, to fight new and evolving financial crime.

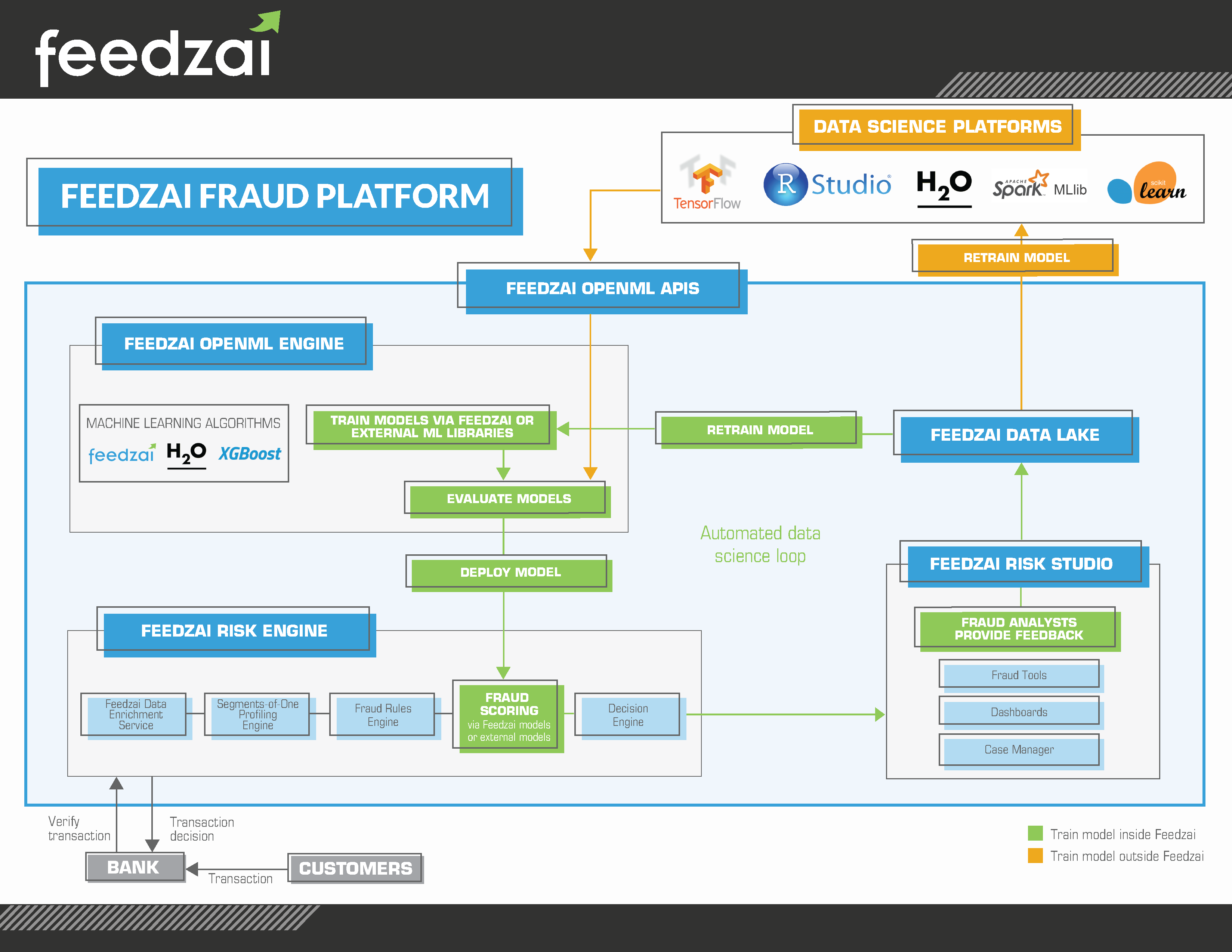

That’s why we built a new service, the OpenML Engine, based on a microservices architecture. The OpenML Engine is the next generation of our industry-leading machine learning product. It includes an SDK for Python, R, and Java. It provides close integration with many commonly used data science and machine learning tools like H20, R Studio, and DataRobot. And it enables you to leverage pre-written machine learning libraries from any open source, like Spark’s MLib, scikit-learn, and TensorFlow. Any future external library or scoring framework can also be leveraged as these become available.

With the OpenML Engine, Feedzai is empowering data scientists to leverage our fraud-fighting innovations on their own terms. The OpenML Engine provides fraud-specific schemas that we’ve built based on our years of experience protecting some of the world’s largest financial organizations. So data scientists at banks can continue to experiment with any modeling approach that exists, and easily bring these approaches to our platform.

What you get is a fraud-obsessed focal point, where the best of your data science meets the best of ours. And because OpenML is extensible to any approach, organizations will be future-proofed as they continue to innovate and work with different tools and approaches.

The OpenML Engine enables the automation of model creation and deployment, whether these models are built inside or outside Feedzai’s platform. This end-to-end connectivity and automation provides seamless integration with Feedzai’s real-time processing for decision-making.

As a result, the time spent on each step goes down by orders of magnitude. For example, for an account opening use case at a bank, we just designed and deployed a model into production in less than two hours.

If it sounds like we’re excited, it’s because we are. The OpenML Engine represents our continued dedication to a mission that hasn’t changed: creating AI that’s attainable, explainable, and controllable, so that even as AI advances, we keep humans in the loop.

RELATED:

Nuno Sebastiao Went to Money20/20 Asia and Said: “AI Is Not Enough”

How Credit Unions Can Use Their Own Big Data to Fight Fraud

Operationalizing Machine Learning for Fraud: Human + Machine Learning is the Best of Both

Share this article:

Jaime Ferreira

Jaime Ferreira is the Vice President of Risk & AI at Feedzai. His team collaborates closely with customers across various sectors to deliver robust fraud and anti-money laundering detection. Jaime's ambition is to create a safer world with less fraud, scams and money laundering.

Related Posts

0 Comments10 Minutes

Boost the ESG Social Pillar with Responsible AI

Tackling fraud and financial crime demands more than traditional methods; it requires the…

0 Comments8 Minutes

Enhancing AI Model Risk Governance with Feedzai

Artificial intelligence (AI) and machine learning are pivotal in helping banks and…

0 Comments14 Minutes

What Recent AI Regulation Proposals Get Right

In a groundbreaking development, 28 nations, led by the UK and joined by the US, EU, and…