The sanctions landscape is a minefield for financial institutions (FIs). Awareness of the risks and dangers involved with violating sanctions regulations is not enough. It’s a zero-sum game. That’s why employing sanctions screening solutions are more important than ever.

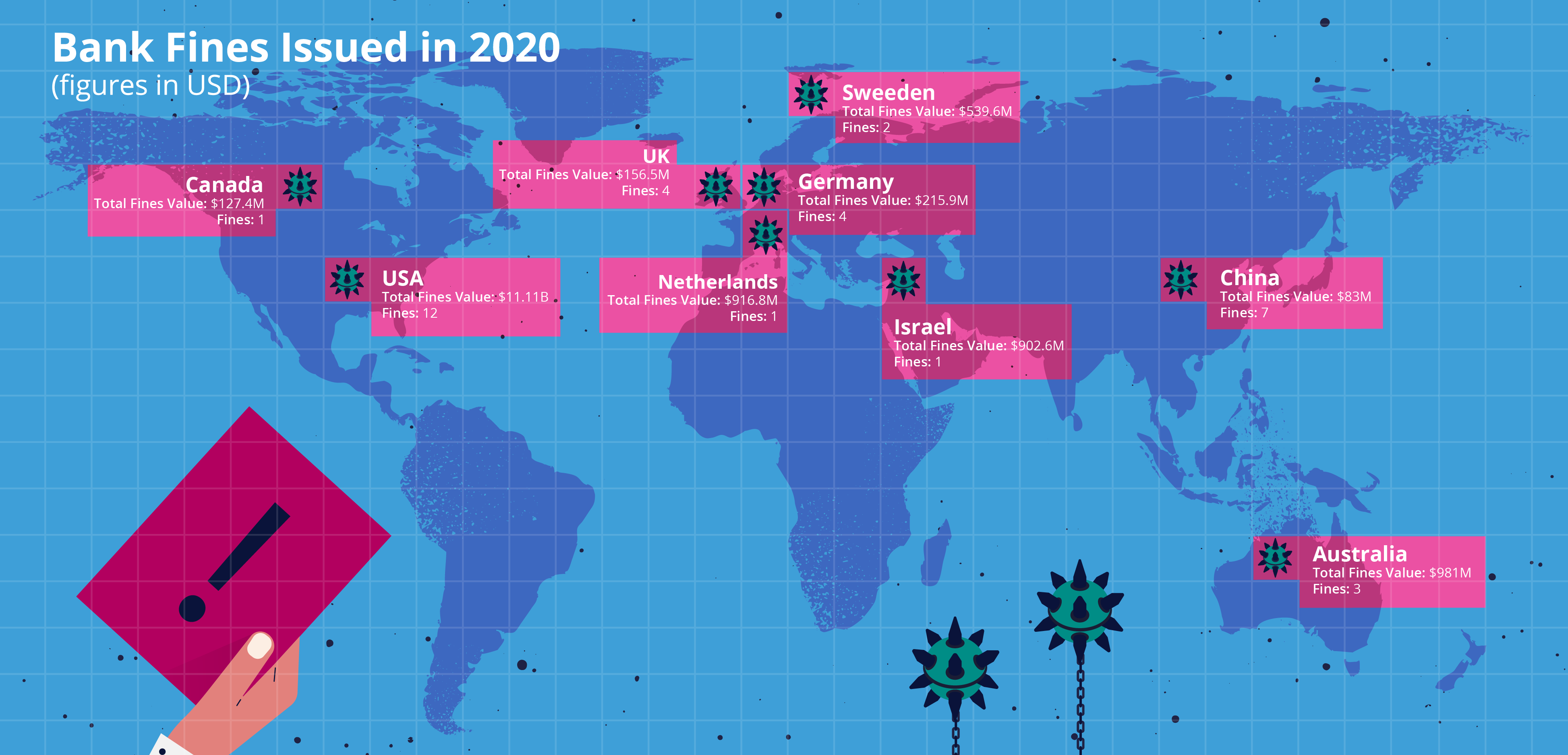

For FIs screening against sanctions watchlists can often feel opaque with high-stakes penalties attached. Regulators fined global banks more than $14 billion last year for a variety of violations, including sanctions compliance and controls related to anti-money laundering (AML) obligations. US financial institutions alone accounted for over $11 billion worth of fines, or nearly three-quarters of total fines issued.

To avoid these costly pitfalls it’s important to understand why the landscape is so complicated. Read on to understand four key challenges your bank is likely to face when sanctions screening and how you can address each one.

To avoid these costly pitfalls it’s important to understand why the landscape is so complicated. Read on to understand four key challenges your bank is likely to face when sanctions screening and how you can address each one.

Challenge #1: The sanctions landscape is continuously in flux

Governments and political entities frequently issue sanctions as a foreign policy tactic against a wide range of targets, including individuals, businesses, organizations, FIs, and government agencies. Sanctions are issued and removed constantly, meaning sanctions watchlists are updated often. Shifting political developments (think Brexit and the Sanctions and Anti-Money Laundering Act 2018) can also have a domino effect of creating new lists that must be reviewed, updated, and monitored.

Adding another layer of complexity is the fact that there are numerous government agencies and political bodies worldwide – including the United Nations, the European Union (EU), and the Office of Foreign Assets Controls (OFAC) to name just a few – that can issue sanctions against a wide range of targets. This means hundreds of organizations in multiple regions rapidly update their respective watchlists.

Solution: Prepare for continuous change

Automation maintains compliance in an environment where sanctions lists are constantly changing. Your bank needs a sanctions screening solution that includes a watchlist management (WLM) functionality automatically updating relevant data instead of requiring manual updates by human personnel. Preparing for continuous change means your organization will need to keep an eye on new sanctions that are potentially coming. Operations and control functions can ensure they are set up to absorb change and are prepared to pivot as required.

Challenge #2: Sanctions screening is complicated

Keeping tabs on individuals, businesses, and entities that are on sanctions lists is just one layer of sanctions screening complexity. Monitoring adjacent actors who are connected to those on the list adds another layer of complexity to the workflow.

Your organization will need to monitor for politically exposed persons (PEP) as part of its screening process. PEPs might not be sanctioned directly but they can work with or be associated closely with those who are sanction watchlists. PEPs pose a higher risk of facilitating money laundering and other financial crimes because they might be called upon to move money at the behest of a sanctioned individual. They are also more susceptible to corruption given their access to, and ability to influence, certain activities. As new payment options like cryptocurrency become more widely adopted you’ll need to stay informed on how these funds are used and how sanctions rules come into effect.

Solution: Bridge the gap between regulator expectations and operational realities

Staying in tune with regulator expectations will help keep your organization from violating any sanctions rules. Regulators will likely have a set of expectations on the type of business you can conduct and with whom. With this in mind, you might consider working with professionals who are experienced in the field of sanctions compliance and can guide you through new challenges. This includes making sure your service level agreements (SLAs) don’t compromise your regulatory commitment.

Maintaining open lines of communication with regulators will also help you to understand their expectations and anticipate changes to the regulatory landscape. Proactive dialogue maintains your understanding of sanctions-related obligations and gives you visibility into how the landscape may be shifting. Proactively plan to embed new or updated requirements into your organization’s workflows. This understanding is critical to ensuring that your operations are able to stay compliant with existing sanctions regulations and anticipate new sanction requirements that may be issued.

Challenge #3: Ensure you do not facilitate sanctioned activities

It’s not enough to understand regulatory requirements and adjust your organization’s operations accordingly. You must proactively perform risk assessments to ensure that your organization is not unwittingly facilitating or aiding any sanctioned activities.

Strong risk assessments will proactively identify opportunities for bad actors (or affiliates) to use your products or services to facilitate illicit activities. Your sanctions screening solution should be a preventative measure in avoiding engagement with sanctioned entities. Consider taking your screening activities to the next level in accordance with identified risks noted during your organizations’ risk assessments. Some activity may not require sanctions screening; however, if your risk assessment has noted it as an area of vulnerability employing basic controls and screening regardless will strengthen your risk management approach.

Solution: Find balance between business and controls

All organizations want to grow revenue and scale their operations. But in the sanctions minefield blindly chasing dollars can have far-reaching consequences if your company is found to have helped a sanctioned entity, individual, or PEP to commit a crime or avoid the screening processes.

Performing regular risk assessments can act as a guardrail to help your organization remain compliant with sanction requirements by understanding all of the relevant players. Review the products in your inventory and scrutinize your organization’s activity to ensure appropriate controls within your operations. Understand how products or new features that you offer can be used to assist sanctioned entities or facilitate illegal activities.

Challenge #4: Rules are often unclear but consequences can be heavy

Conflicting communications only add to sanctions screening headaches. If your organization is headquartered in the United States with operations in a potentially high-risk jurisdiction, US regulators could warn you that you are not allowed to conduct business with certain sanctioned entities in that jurisdiction. And that jurisdiction may have its own regulators which will take a contrary position.

While the rules are confusing, the consequences can be severe. And not just because of the potential fines. Remember, regulations are in place to stop illegal activities and prevent real criminals and terrorist groups from inflicting suffering on real human beings. If your organization is found to have been facilitating illegal arms deals, terrorist financing, laundering money for criminals, or aiding a human trafficking ring, the reputational damage will be devastating. Again, sanctions screening is a zero-sum requirement.

Solution: Serve multiple, sometimes conflicting regulators

The best way to mitigate the risk of sanctions compliance is to embrace solutions that fully understand the confusing and chaotic sanctions landscape. Take stock of the jurisdictions your products and services are offered and the areas in which your firm operates. You will need to ensure these jurisdictions and the associated watchlists issued are considered in your screening approach. Sanctions screening systems can be used to understand existing sanctions, review numerous watchlists, and outline how existing sanctions impact your operations. These solutions can also peel back layers of ownership of those involved in a transaction to reveal whether your organization is at risk of engaging with higher-risk entities.

Sanctions screening technology is making it easier for organizations to prevent violations in the first place. Technology has the power to make sanctions screening more efficient, transparent, and thorough to protect your organization. It’s critical to utilize a solution that meets and helps you exceed regulatory expectations.

Current anti-money laundering solutions just produce too many false positives. Download our eBook to learn How to Evolve Your Suspicious Activity Detection and shift away from legacy defensive SAR filing approaches.

Share this article:

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…