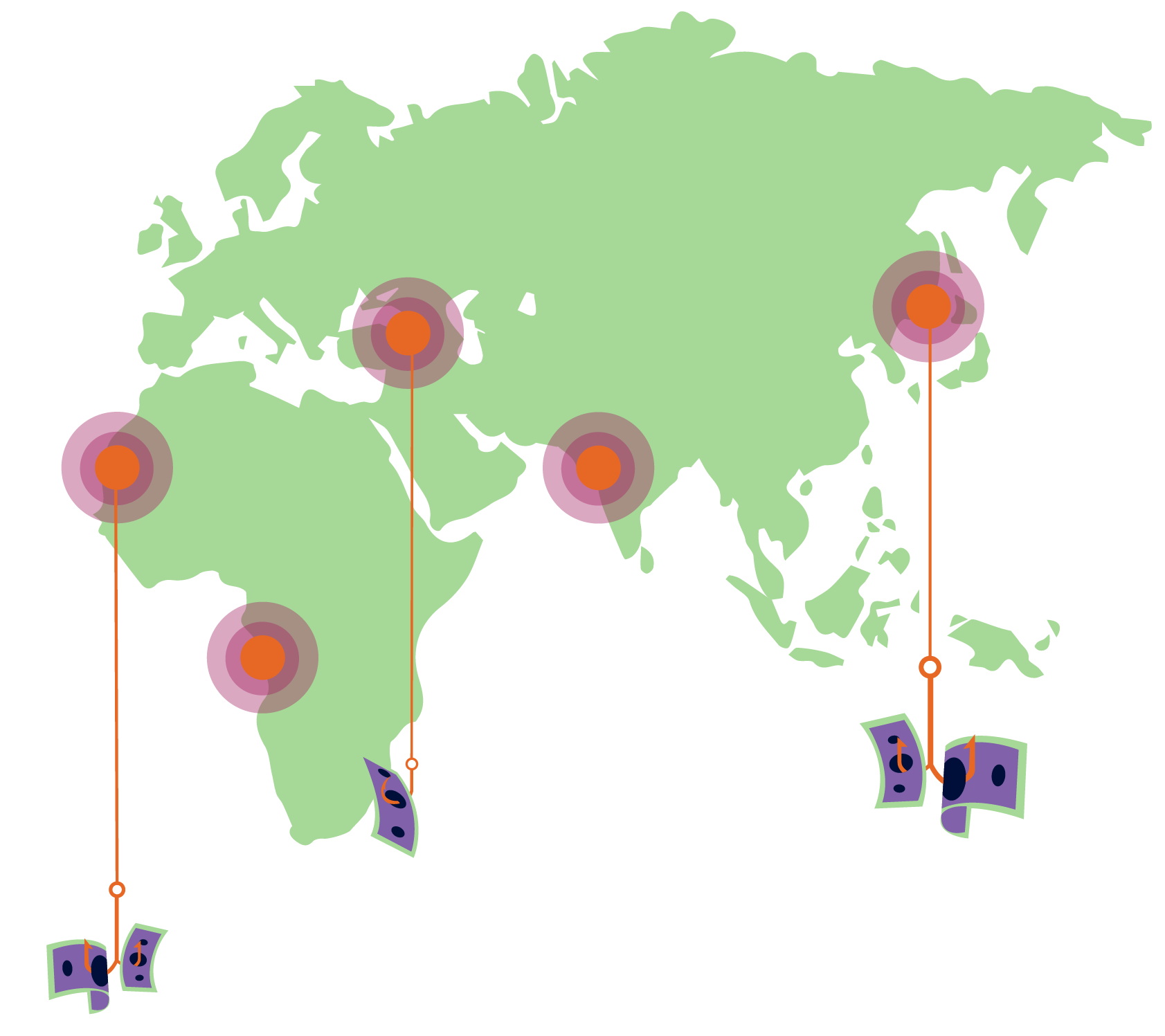

Infographic

Global Fraud Hot Spots

and How Banks Can Cool

Them Off

Fraud Hot Spots Around the World

Fraud is a global problem. Some fraud types are more likely to originate from specific geographies than others. Here are some of the most troublesome fraud hot spots, the common types of fraud that originate from each location, and how financial institutions can address fraud hot spots.

The Top 5

Global Fraud Hot Spots

#1

Turkey

Favored Fraud Types:

Mobile trojan banking malware with SMS grabbers and screen overlays, on-device fraud (ODF), and integration with automated transfer systems – a malware-as-a-service feature that enables criminals to move money using APIs.

Frequent targets:

Australia, Germany, Italy, Poland, Spain, UK, and USA.

#2

Nigeria

Favored Fraud Types:

419 or letter scams, romance scams, and CEO fraud.

Frequent targets:

India, UK, and USA.

#3

India

Favored Fraud Types:

Tech support scams, remote access trojans or tools (RATs), account takeover (ATO), and new account fraud.

Frequent targets:

UK and USA.

#4

Morocco

Favored Fraud Types:

ReelPhish and SIM Swap.

Frequent targets:

Latin America, Middle East, and Southern Europe.

#5

North Korea

Favored Fraud Types:

State-sponsored hacking and cyberattacks.

Frequent targets:

Japan, South Korea, NATO allies, and US-based industries (banking, entertainment, finance, cryptocurrency, and infrastructure).

3 Ways Banks Can Address Fraud From All Hot Spots

1

Work with Partners to Future-Proof Your Operations

Work with a trusted provider who understands that fraudsters constantly shift tactics. Stay up to date on the latest trends and future-proof your operations with partners who can protect any transaction type.

2

Know Your Customers’ Normal Behaviors

Build digital customer profiles based on every customer interaction to know how they normally behave. This makes it much easier to know if customers are behaving unusually or if a fraudster is attempting to access their account.

3

Know Your Customers’ Devices

Know your customers’ devices and how they normally interact with them. Assess interactions to determine if the device used to log into accounts is associated with the customer or if it is an unfamiliar one from an unfamiliar location.

Fraud comes in many forms and across different locations. Following these tips is an important step for banks worldwide to keep their customers safe in an expanding global economy.

Sign up for our newsletter

Stay Up-to-Date on Financial Risk Management

We care about protecting your data. Here’s our Privacy Policy.