Whether it be credit, debit, in person, or online, payment cards continue to be one of the most convenient ways for consumers to transact. Unfortunately, fraudsters also find convenience in inflicting financial damage across these card channels. This results in both significant costs for card issuers and negative, distrustful customer experiences.

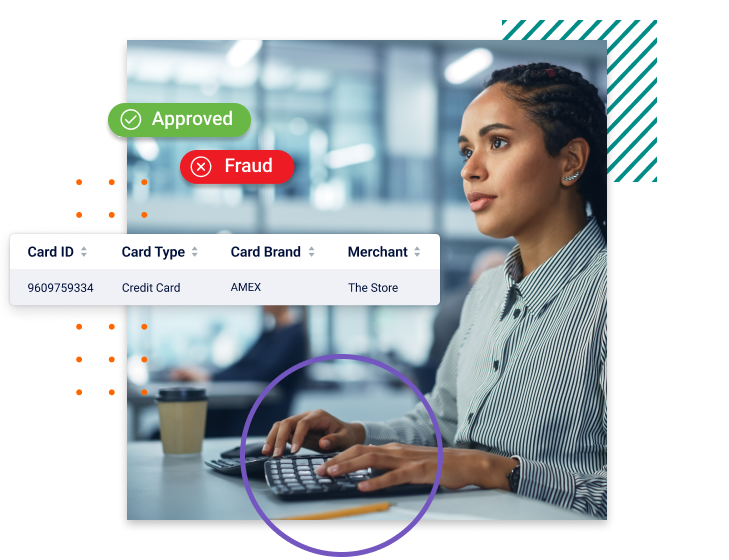

Download our solution sheet to learn how Feedzai’s Transaction Fraud for Cards solution:

- Utilizes best practice strategies, rules, and models to detect top card fraud tactics;

- Uses production-ready APIs to stop card present and CNP fraud in real time;

- Leverages hypergranular profiles to create top-notch customer experiences.

Sign up for our newsletter

Stay Up-to-Date on Financial Risk Management

We care about protecting your data. Here’s our Privacy Policy.