You can thank criminals like Pablo Escobar for the current slate of anti-money laundering (AML) compliance regulations that we face today (more on him later). These policies are crucial to stopping illegal criminal organizations like the ones Escobar and his ilk operated. Drugs, terrorism, trafficking, slavery, illegal weapons sales - these are just a few of the major atrocities criminals to earn money illegally. That’s why banks need strong anti-money laundering compliance in place to bring these horrific deeds to light and stop criminals from profiting from crime and suffering.

What is Money Laundering?

Before we delve into Escobar’s sordid history, let’s start with a basic question: what is money laundering?

Money laundering is the illegal process of making profits from criminal activity – including the drug trafficking, illegal weapons sales, human trafficking, and terrorist funding we mentioned earlier – appear legitimate. It involves disguising the true origins of the money by moving it through a complex sequence of banking transfers or commercial transactions. This layering tactic makes it difficult for authorities to trace.

A Brief History of Anti-Money Laundering

Escobar, as you’ll recall, was the notorious Colombian drug lord and narco-terrorist who made a lot of money selling white powder. Well, he made so much money that he couldn’t explain it to his local bank manager. So he had to anonymize his source of wealth and funds by placing it in companies, investments, casinos, and so forth. It wasn’t an entirely original idea; the mafia had been doing it for years. However, Escobar took it to a whole other level. It turns out that the white powder is wildly popular.

The Medellín Cartel brought in more than $420 million per week or almost $22 billion per year. Weekly, they smuggled 15 tons of cocaine, worth more than a billion dollars, into the US. The cartel had so much money it spent over $1,000 weekly on rubber bands to wrap stacks of cash. They even wrote off 10% of the money because of “spoilage” — rats nibbled on it as it sat in warehouses.

Back in the 1970s, there was no Internet. Financial services weren’t globally connected through digital banking. When he was questioned in 1993 about the essence of the cocaine business, Escobar replied with, “[the business is] simple: you bribe someone here, you bribe someone there, and you pay a friendly banker to help you bring the money back.”

The Modern Money Laundering Landscape

Today, what’s shocking is how true his statement remains. Despite advancing global regulations, awareness of the heinous impact of these crimes, and the Bribery and Corruption Act of 2010, money-laundering flourishes. What is more, it’s glorified. Shows like Breaking Bad, Ozark, and Narcos really glamorize the material wealth of money launders like Escobar. Audiences are thrilled by exotic cars, glamorous homes, and dream vacations. But if we saw those possessions as funded by blood, rape, and murder, would they still be so sexy?

What’s more, money laundering tactics have evolved considerably since the days of Escobar’s heyday. While cash is still used by underworld figures, bad actors have expanded their horizons and diversified their efforts to conceal their revenues and criminal activities. Criminals moved to structuring, transfers, and are now using modern payment methods like crypto to keep a low profile.

The good news is now we have laws to prosecute the predicate crimes of money laundering, and banks across the world have to comply with these laws. Today we also have the concept of the proceeds of crime. We have unexplained wealth orders, which means if your declared wealth can’t explain your lifestyle, you can be investigated.

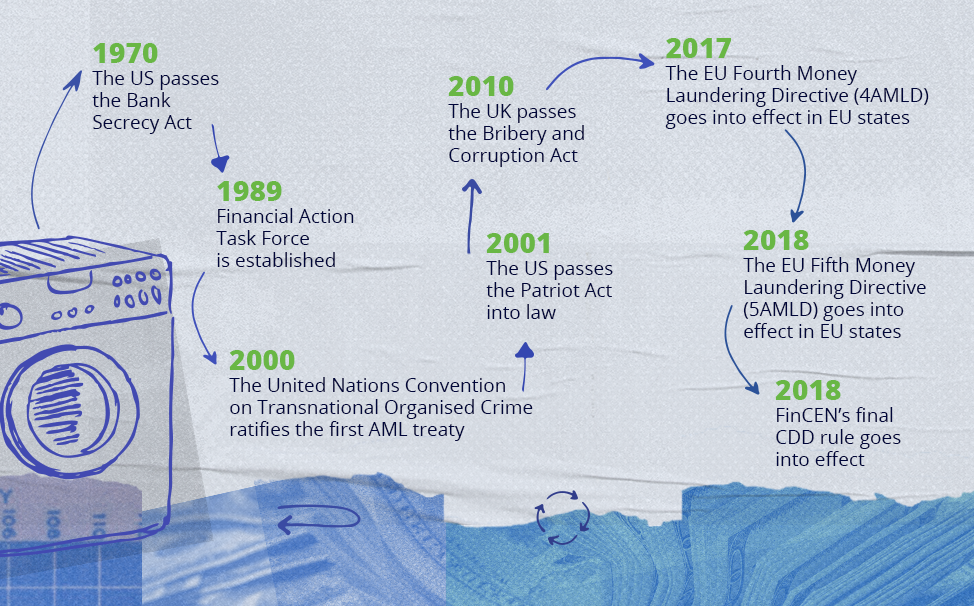

All these regulations were implemented because of criminals like Pablo Escobar. Authorities were looking for a way to catch him, but they didn’t even have a basic set of laws to define what money laundering was. In fact, they didn’t even have a general consensus on how you could begin to stop it. The U.S. passed the Bank Secrecy Act in 1970. However, it wasn’t until the 1980s that it started to gain traction and see successful prosecutions. (It’s come a long way since then and now helps lead the global fight against money laundering).

FATF and the UN’s Convention on Transnational Organised Crime

Two critical global political changes addressed the lack of money laundering regulation and they continue to impact all anti-money laundering programs today: the formation of the Financial Action Task Force (FATF) and the UN’s ratification of the first AML crime treaty, the Convention on Transnational Organised Crime.

What is FATF?

FATF is an intergovernmental body established in 1989 with the objectives to set standards and promote effective implementation of legal, regulatory, and operational measures for combating money laundering, terrorist financing, and other related threats to the integrity of the international financial system. The agency is the global “policy-making body” that works to generate the necessary political will to bring about national legislative and regulatory reforms in these areas. Its mission is to evaluate and rate countries that have signed onto their treaties for compliance. In some ways, it becomes a peer pressure initiative. FATF’s forty recommendations are the global foundations of all anti-money laundering compliance regulations.

What is the Convention on Transnational Organised Crime?

In 2000, the United Nations Convention on Transnational Organised Crime (mafia, cartels, terrorists, etc.) ratified the first AML treaty which has now been signed by 190 countries — recently Afghanistan in 2018 — making this the legally binding agreement of all signing countries to combat money laundering, human trafficking, arms dealing and organised crime. The Convention makes it uncomfortable for signing countries to operate in ways that are friendly to financial crime.

The Convention is what empowers regulators to push banks to do more to fight financial crime. Countries sign the treaty because it gives their institutions access to financial products and services, which would otherwise be restricted. Prior to signing the treaty, Afghanistan could look the other way when it came to proceeds from the sale of opium. However, today they at least have to acknowledge AML — something they’ve avoided for thirty years. This illustrates how the nets are closing.

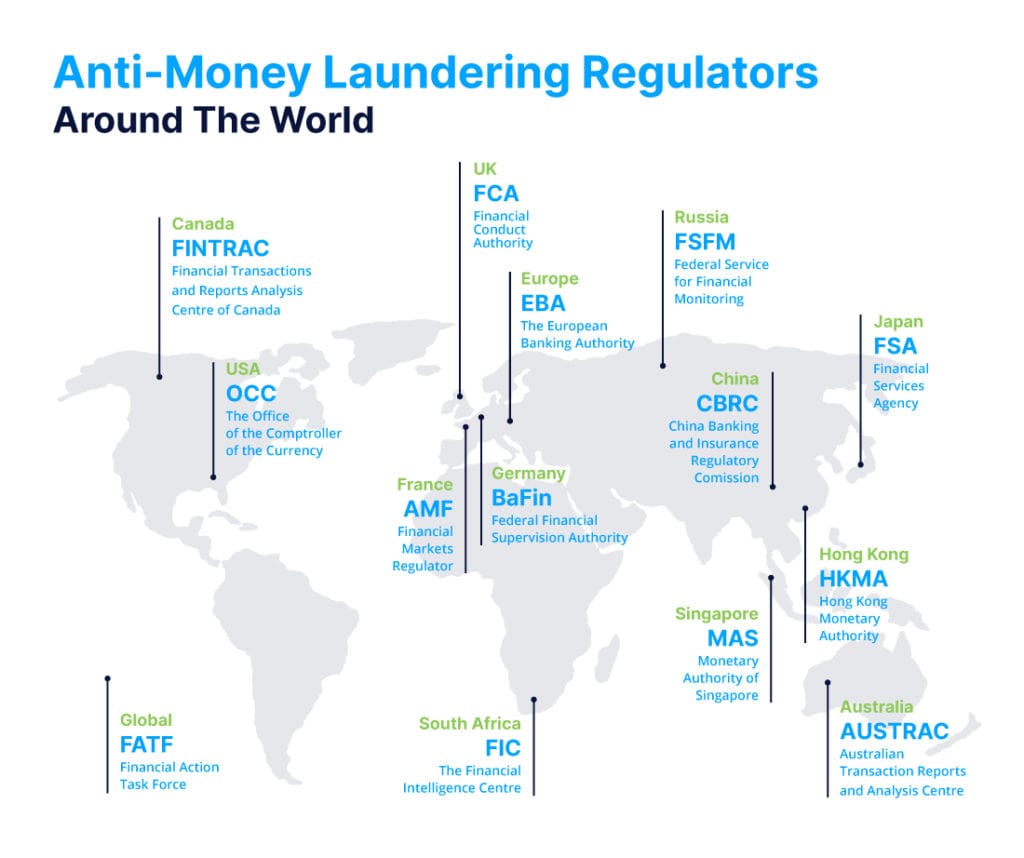

Financial Crime Compliance: Components of Governance

Every country that signed the Convention treaty has a financial regulator. These regulatory bodies spearhead change and set standards for financial institutions. Here are some of the global ones.

Regulators’ powers are far-reaching. For example, sanctions are global because if you trade in American dollars, the OCC won’t authorize the release of their currency in your country. Nor will they allow your firm to offer any products that relate to the US dollar. In the UK, it’s the Financial Conduct Authority (FCA) that reprimands and fines based on your conduct. If your conduct promotes or permits money laundering, the FCA will fine you.

The important thing to remember about the regulators we’ve listed here is that they all talk to each other. Anti-money laundering compliance and regulation is a small world, after all. If you see a policy coming out of the Federal Service for Financial Monitoring (FSFM) in Russia, it will generally have its origins from FATF or the OCC. The end goal is to ensure that the markets remain open.

Components of Anti-Money Laundering Compliance

This is an oversimplified explanation of a complex structure, but I’m prioritizing accessibility and speed.

Government

Returning to Escobar, governments didn’t have a way to tax the money he was making. They realized they needed to force him into products they could seize. Plus, they wanted a way to control the flow of funds. The answer was to create national policies, and so they set-up a legal framework for enforcement actions. Today, almost every country requires a risk assessment of businesses, products, customers, and geographies.

Law enforcement

It’s law enforcement that investigates, bangs down doors, confiscates computers, and sends people to court.

Regulators

Next, or in parallel with law enforcement, comes the regulators. They issue licenses for banks and other regulated entities, ensure investments are sound, make sure all the other players are behaving appropriately, and issue fines if they’re not. Regulators also perform reviews of systems and procedures in place, test the soundness of AML programs, and ensure all regulations are being followed according to the bank’s risk appetite. Most importantly, regulators are responsible for updating regulations.

Regulated entities

Last, but not least, are the regulated entities. These are the banks and financial institutions that must operate to a certain standard to maintain their charters and/or licenses. This category also includes businesses and industries such as casinos, precious metal dealers, auto dealers, money services businesses (MSBs), and more.

All the components of governance create a perpetually interconnected network.

Now that we understand the origins of anti-money laundering and the global interconnectedness between governance components, we need to address Know Your Customer (KYC) requirements. And we’ll do just that, in the next post: AML 201.

Share this article:

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…