Criminals make their money from a variety of illicit activities. This includes, but is not limited to, drug sales, illegal weapons, slavery, and more. These underworld activities can yield significantly high profits for criminals - but only if they are able to move the money into legitimate financial systems. This is why many criminals turn to money mules to launder their funds into banks. And why banks need behavioral biometrics for mule account detection.

What are Money Mules?

Money mules act as middlemen for criminal organizations by providing bad actors with a pathway into legitimate financial services. They come in three distinct categories:

The first type of money mule is an unwitting participant in a criminal scheme. This may include someone looking for work opportunities who is manipulated into letting criminals access their bank account. The second is a willing participant – someone who understands they are helping a criminal enterprise but are undeterred because they believe they will profit from their efforts. The third type of mule is someone directly connected to the criminal organization. They will open a bank account (most likely with a synthetic ID) for the purpose of laundering illicit money.

Money mule scammers often recruit people by posting fake job listings or promising easy money for little effort. If they agree to participate, the criminal instructs them to move money on behalf of their “employer” – which can include cash, cryptocurrency, gift cards, direct deposits, or receiving physical goods at their address. Criminals promise compensation to participants who have become money mules.

The global COVID-19 pandemic drove millions of people living in the APAC region into poverty, according to a recent report by Asia Development Bank. This gave criminals a golden opportunity to recruit more people to act as money mules. Young people in their teens and 20s are particularly susceptible to money mule recruitment tactics.

How Serious a Problem are Money Mules in APAC?

If criminals are successful, the penalties for APAC banks can be severe. Recent data shows the collective fines paid by APAC banks surpassed $10.6 billion USD for non-compliance with anti-money laundering (AML) requirements.

Criminals turn to money mules to launder their money because they believe banks will view them as trustworthy parties. But recent advances in technology – including behavioral biometrics – are enabling banks to track criminals and detect money mule accounts linked to money laundering, enabling banks to detect such activity earlier and respond faster.

What is Behavioral Biometrics?

At the most basic level, the key to fighting money laundering is understanding what’s happening behind the scenes. Behavioral biometrics can help banks understand how their customers normally behave and can flag behaviors that are red flags for money mules.

Behavioral biometrics solutions have already proven effective at stopping account takeover (ATO) fraud attacks. In an ATO attack, an impersonator hijacks someone else’s profile and misuses it to buy goods using the victim’s payment information or transfer money out of their account. Behavioral biometrics enable banks to understand whether a customer really is who they claim to be and stop fraudsters before they can reach the point of transaction.

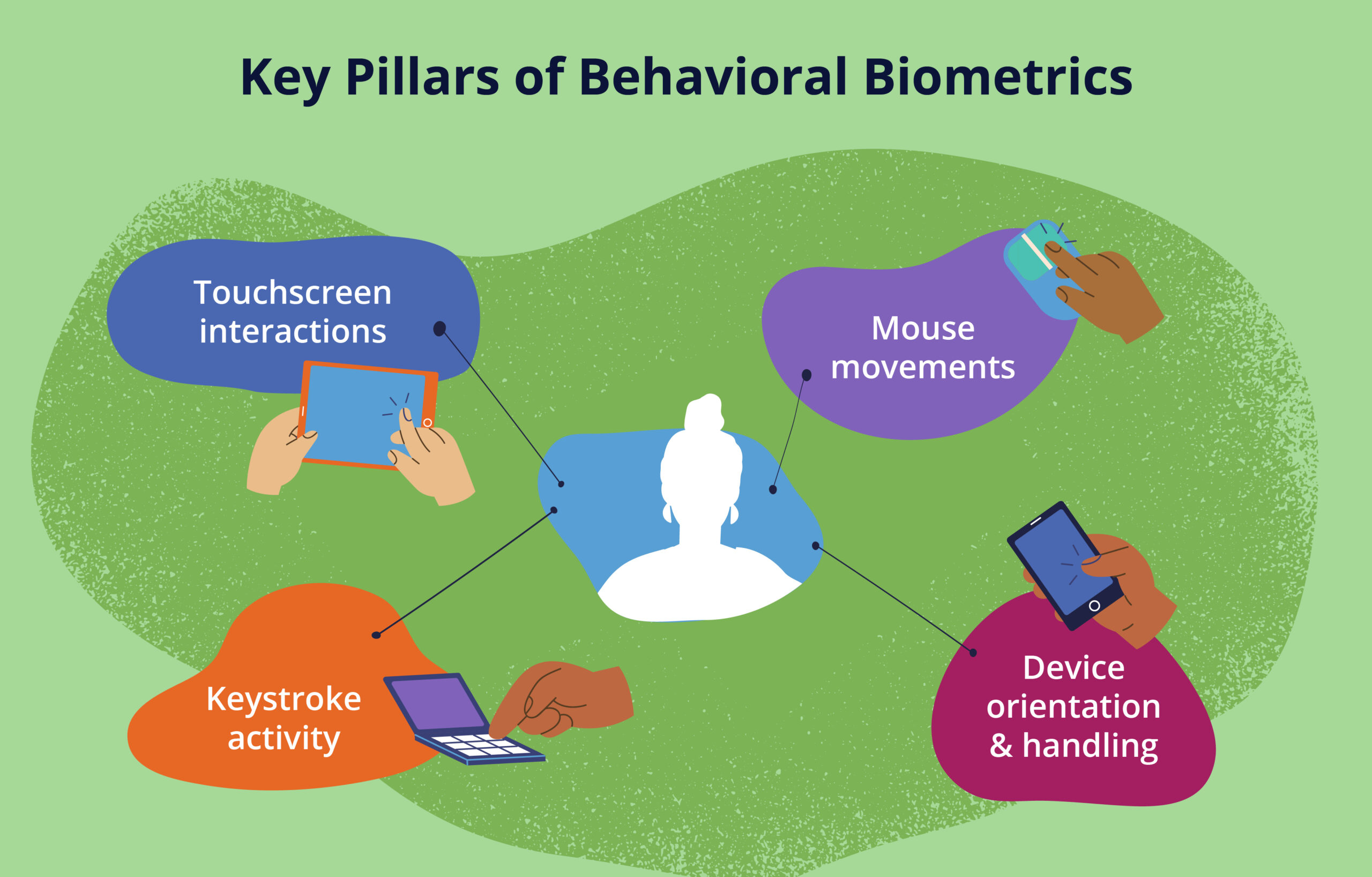

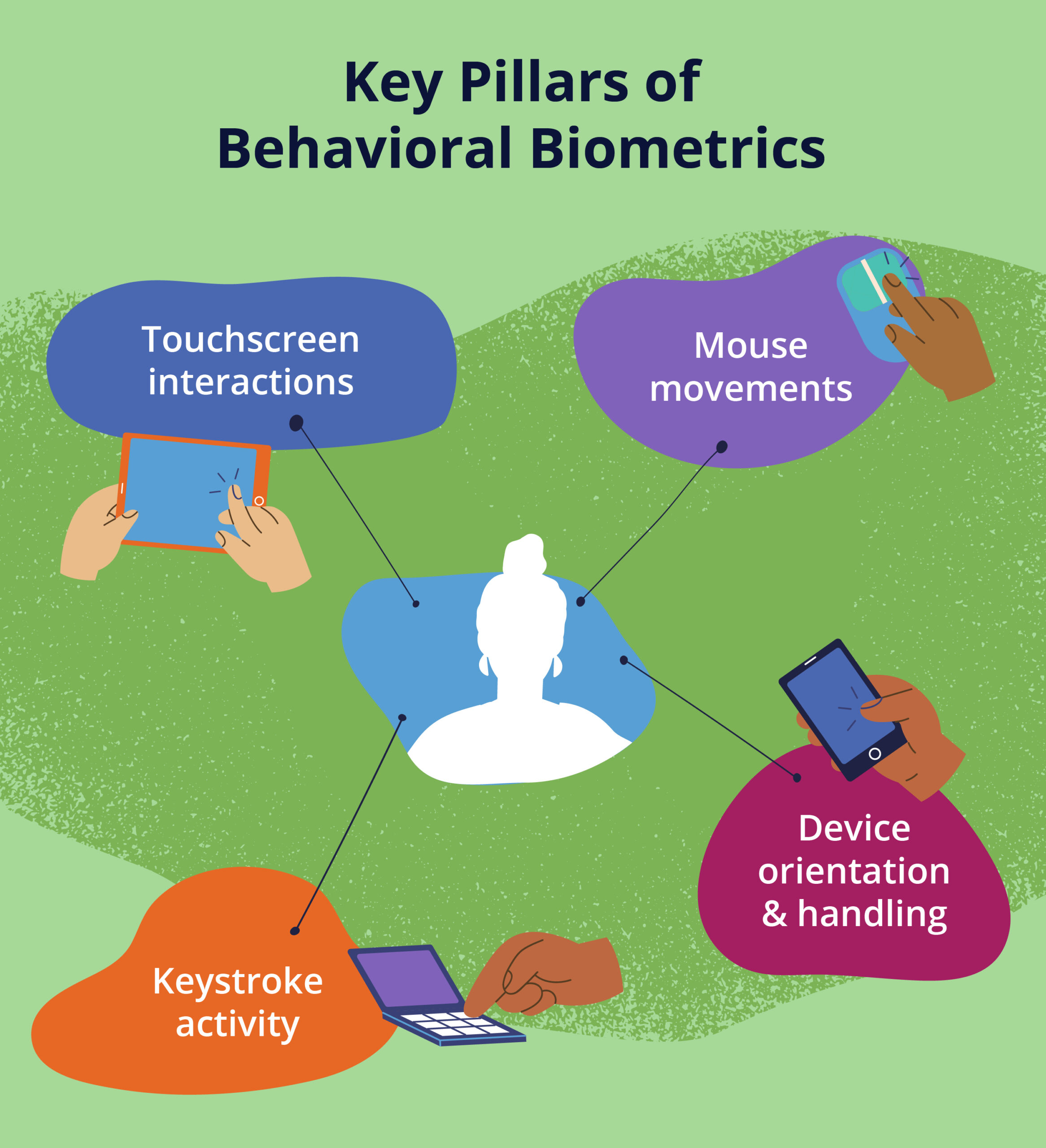

Here’s how it works: behavioral biometrics technology analyzes how humans typically interact with their devices and accounts, such as what time they login, the way they touch their device screen, or move their mouse. By implementing behavioral biometrics, your fraud teams can analyze hundreds of parameters that make up someone’s online behavior to assess whether the person behind the screen is a legitimate customer or someone impersonating them.

The way your customers click on their phone screen and press buttons is biometric data that makes up a profile of who they are. It becomes their digital identity that cannot be replicated. This digital identity becomes their unique barcode and financial institutions can use it to identify good customer interactions and distinguish them from possible criminal activity.

In other words, behavioral biometrics offers FIs an entire suite of frictionless security controls. These controls both quicken and enhance the fraud detection process for greater accuracy. What’s more, applications of behavioral biometrics extend beyond fraud prevention. It also opens new possibilities for your bank to identify money mules who are attempting to launder money through your organization.

How Can Behavioral Biometrics Detect Money Mule Accounts?

Behavioral biometrics offers four distinct benefits:

- Flags abnormal user behavior for a genuine account holder – such as uncertainty in how they interact when making a transfer;

- Flags transactions that pose a higher risk of being mule activity – like engagement with unfamiliar accounts;

- Detects typical suspicious behavior during the account onboarding stage and prevents criminals from opening new accounts to launder money;

- Identifies individuals behind a criminal operation. From there, banks can use link analysis to detect the other mule accounts under their control. Banks can identify the mule activity and report the activity to authorities.

Behavioral Biometrics is Already Battle-tested for Money Mule Detection

Criminals need to use everyday people with legitimate bank accounts to act as money mules in their schemes. So how can behavioral biometrics catch money mules? Understanding how these account holders typically behave is the key to uncovering illegal activity.

In one case, cybercriminals targeted a large bank by launching a focused advertising campaign to lure people into acting as money mules. Customers fell for the deception and found themselves part of a money mule network. The only way to solve this issue is to rapidly identify the entire network using money mule account detection.

The bank’s team leveraged behavioral biometrics to profile the money mule activity. Approximately 425 money mule accounts were detected in a matter of days. Authorities were handed over the information gathered to assist them in their criminal investigation.

Mule Account Detection Without Impacting the Customer Experience

Behavioral biometrics-based AI technology works silently in the background. It leverages machine learning risk models to look for unusual behavior indicative of suspicious activity. However, it does not interfere with the customer experience. Customers can proceed with their business uninterrupted, while banks can feel confident that only legitimate customers are using their services.

Technology evolves fast and mule networks play a crucial role in helping criminals’ money laundering efforts evade detection. Behavioral biometrics is now a core component to prevent financial crime, by making digital trust a central pillar of every online banking transaction.

Share this article:

Sean Ryan

Sean Ryan is the Head of Feedzai's Fraud and Financial Crime Prevention in the Asia-Pacific region. Sean has over 25 years of experience in enterprise transformation, with 15 of those focused specifically on transformation across fraud and financial crime prevention. Previously, he held global leadership roles, with direct experience working across EMEA, Americas, and throughout the Asia Pacific. Prior to joining Feedzai, he provided independent advice specific to this domain, to clients across financial services, the technology sector, and top-tier services providers globally. He’s passionate about leveraging today's technology and data to prevent financial crime.

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…