Behavioral biometrics is an advanced way to confirm people’s identities by studying how people behave online. The solutions use artificial intelligence (AI) and machine learning to turn behaviors into biometric data.

Fraud prevention is a constant challenge for financial institutions. Bad actors can easily compromise traditional customer verification tools like passwords and PINs. That’s why these tools are less effective at preventing fraud.

As older methods their effectiveness, there’s growing interest in using this technology to address this issue. That’s where behavioral biometrics comes in. This technology goes beyond traditional data points and learns how users physically and behaviorally interact with their devices.

This article explores how the banking industry can use this advanced technology for fraud detection and prevention. Learn how the solutions improve user experiences, reduce false positives, and foster trust between customers and their banks.

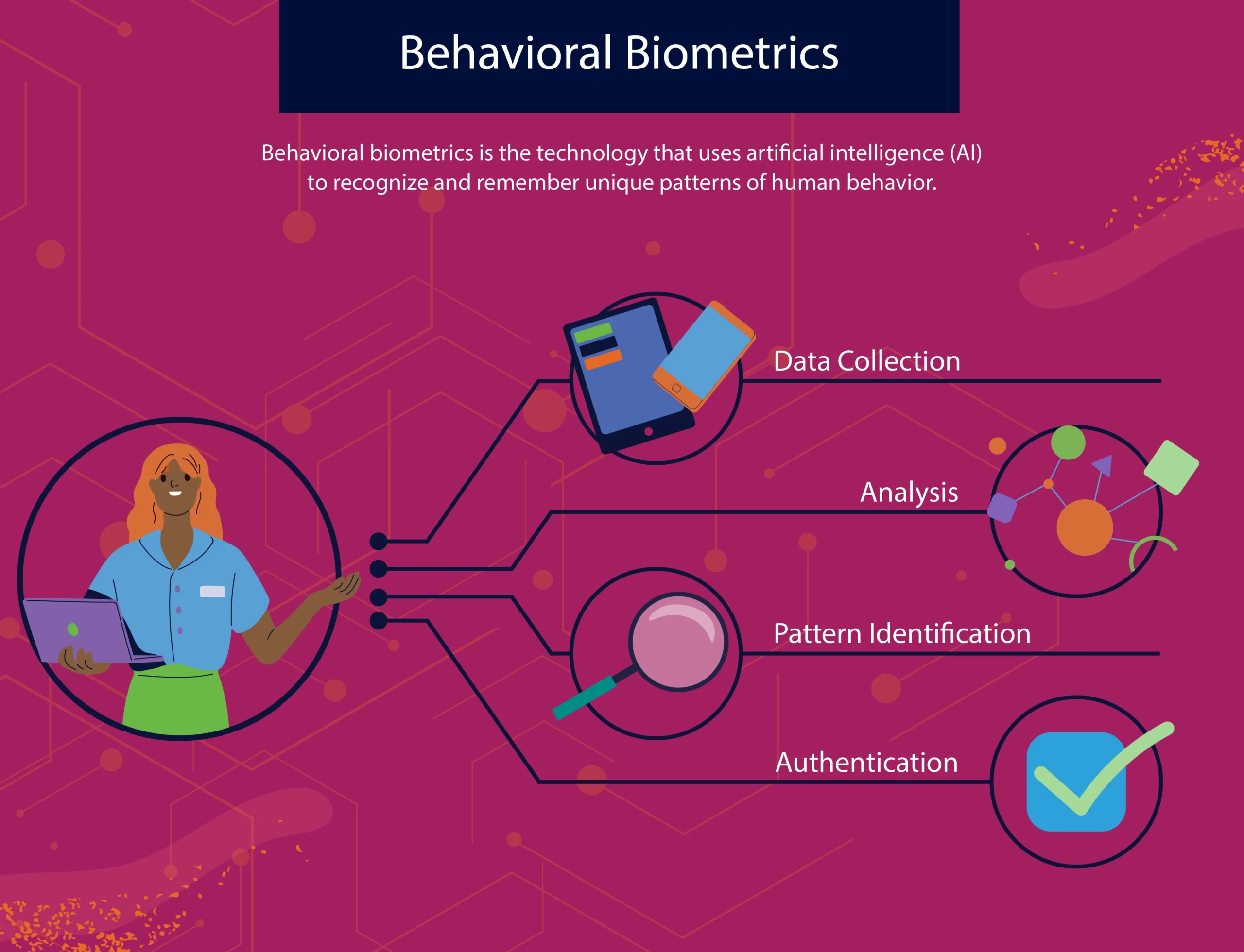

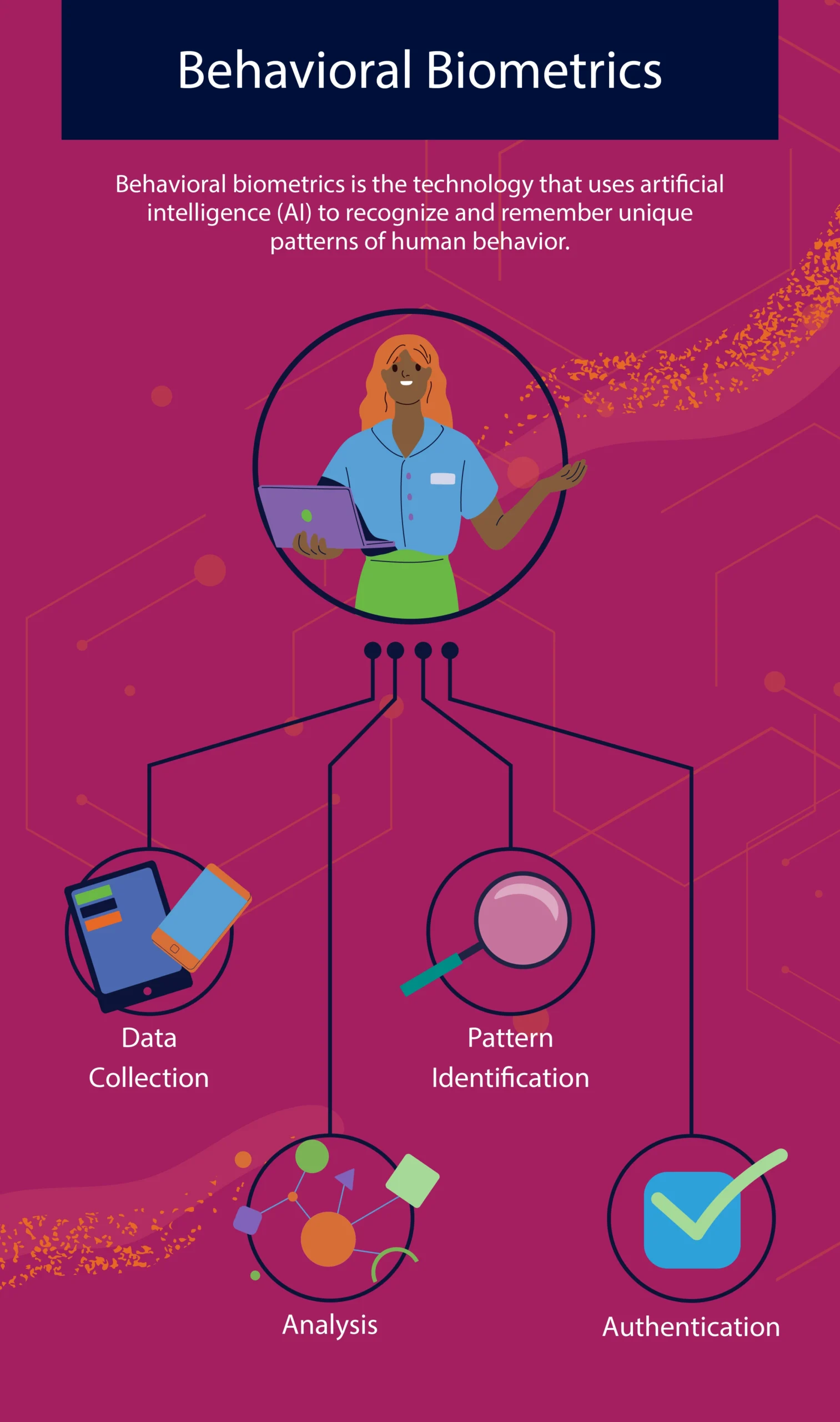

What is Behavioral Biometrics?

Behavioral biometrics technology uses artificial intelligence (AI) and machine learning (ML) to identify and remember unique human behaviors. Physical biometrics like fingerprints and retinal scans rely on unchanging characteristics. Behavioral biometrics stands apart by studying unique individual actions. This includes how a person types, the speed at which they swipe on a touch screen, or their mouse movements.

These seemingly normal activities hold large amounts of data that can accurately tell different users apart. This makes behavioral biometric data a valuable fraud prevention tool.

How Behavioral Biometrics Improves Fraud and Scam Prevention

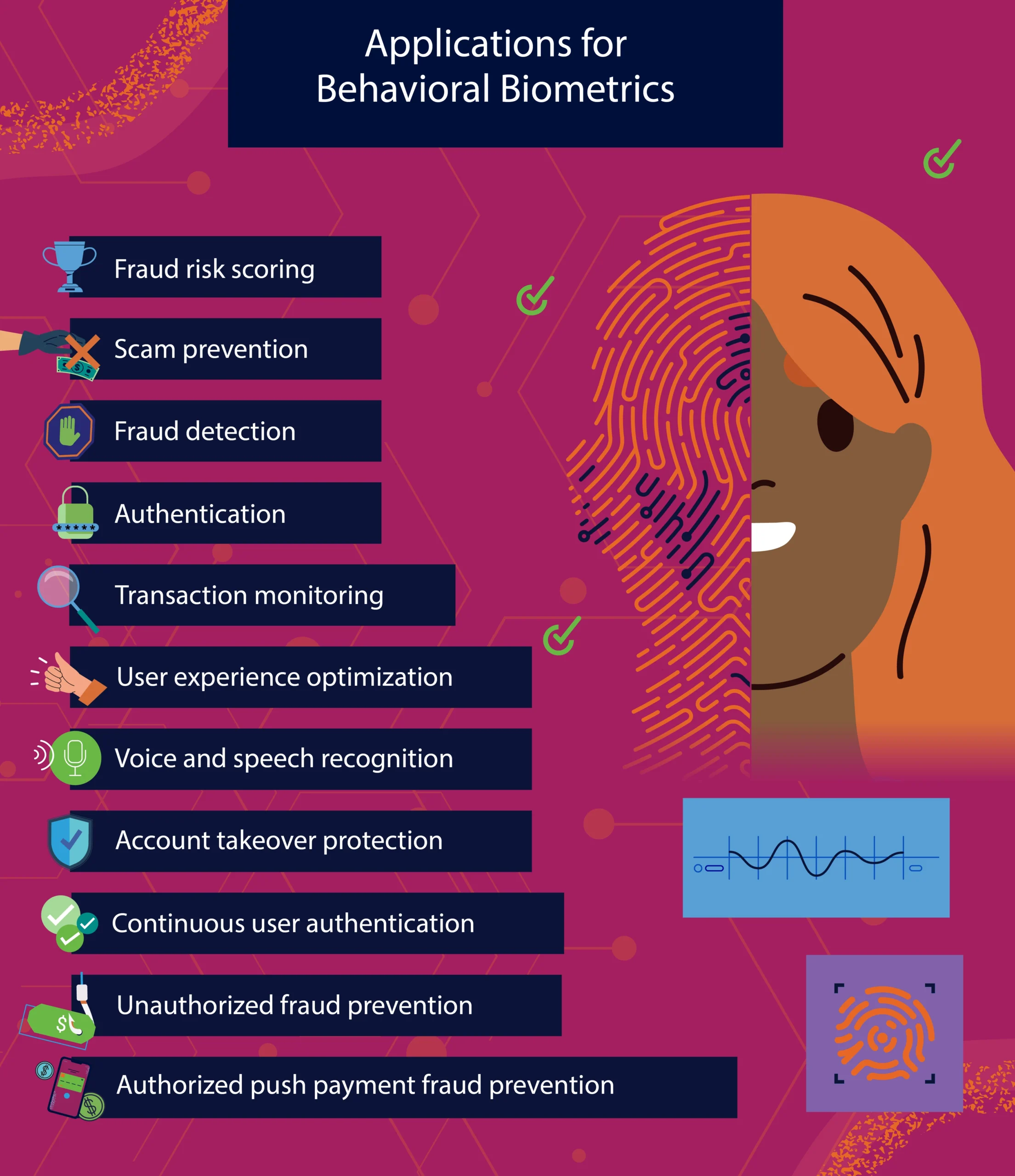

Banks can analyze various online behaviors to detect anomalies and potential fraud in real-time.

Typing patterns and keystroke monitoring

Analyzing a user’s unique pattern typing speed or keystroke movements creates a baseline for normal typing behavior. Sudden changes in typing speed or keystrokes can raise red flags and trigger fraud alerts.

Mouse movements and navigation

Individuals’ mouse movements and website interactions provide additional behavioral biometric data. Unusual movements, rapid clicks, or strange navigation patterns can indicate fraudulent activity.

Touchscreen interactions

Review the pressure a user applies, their swipe gestures, and the touch patterns on a device screen. This behavior can detect consistent user behaviors and detect new patterns that indicate fraudulent activity.

Device recognition

Banks should watch the devices customers use (e.g., phones, laptops, or computers) to access their accounts. For example, someone trying to commit fraud might use a different device or log in strangely to avoid detection.

Location and IP address analysis

Login attempts from an unfamiliar location or an IP address associated with suspicious activities can trigger additional security measures or verification steps.

Behavioral analytics

Banks can analyze vast amounts of behavioral data to create unique customer profiles. These profiles can include a range of factors like transaction history, spending habits, login times, and other behavioral patterns. Unusual transaction amounts or out-of-pattern behaviors can trigger alerts, warning of suspicious activity.

By reviewing behavioral biometrics data and customer account activity, banks can proactively detect potential fraud risks. Banks can quickly respond to protect customers if suspicious activity happens. Responses may include alerting the customer, a temporary account freeze, or asking for additional information to approve a transaction.

How Behavioral Biometrics Enhances Fraud Prevention

Continuous Review

With traditional methods, the validation occurs only at the login stage. A user can access their account by entering the correct password.

Behavioral biometrics differs by using ongoing reviews. The technology constantly analyzes the user’s behavior in the session. This adds additional security that is hard to breach and makes it easy to detect unauthorized activities.

Reducing False Positives

Fraud detection systems often trigger false positives, causing unnecessary inconvenience for customers. Behavioral biometrics, which is more precise, significantly reduces false positives, resulting in a better customer experience.

Detecting Emerging Fraud Techniques

Advanced techniques such as bots, RATs (Remote Access Trojans), and aggregated attacks are critical threats to banks. By analyzing subtle behavioral cues, behavioral biometrics can detect and prevent these sophisticated attacks, offering a proactive approach to fraud prevention.

Data Privacy Protection

The technology is a highly effective fraud prevention tool. But it’s also important to consider data privacy when using it.

Profiling Through Behavior

Behavioral biometric data, by nature, is revealing. It offers deep insights into a person’s habits, tendencies, and preferences. However, using the information to profile individuals is a serious risk. Marketing campaigns could target users based on their data, or worse, they could face discrimination.

Data Breaches

The threat of data breaches is another concern. Sophisticated hackers might compromise behavioral biometric data, enabling them to pose as legitimate customers and access their accounts. Given the personal nature of this data, the consequences could be severe.

Strengthening Data Privacy: Tips for Banks

Banks must take steps to protect customer behavioral biometric data and proactively address customers’ concerns. This includes encrypting the data and only using it for fraud prevention purposes. With the correct strategy and conscientious practices, it’s possible to leverage behavioral biometrics for fraud prevention while respecting and preserving data privacy.

Banks should also be transparent with their customers about how they use behavioral biometrics. This will help to build trust and ensure that customers feel comfortable using this technology.

Here are some additional tips for banks on how to protect the privacy of their customers’ behavioral biometrics data:

Minimal Data Collection

Only collect the minimum data required for fraud prevention. Avoid the temptation to gather more just because you can. Minimal data collection limits exposure to potential breaches.

Robust Encryption

Invest in strong data encryption measures and secure storage solutions. An encrypted dataset is like a treasure chest that needs a key to unlock it. It offers an extra defense layer against fraud.

Single-Purpose Use

Only use the collected behavioral biometric data for fraud prevention. Shifting use cases into areas such as marketing risk eroding trust and potentially breaching privacy regulations.

Explicit Consent

Always ask for explicit consent from customers before collecting and using their behavioral biometric data. Respecting user autonomy is essential when choosing how to use their personal information.

Transparency

Inform customers about behavioral biometric data collection, data usage, and measures taken to safeguard their information.

Benefits of Implementing Behavioral Biometrics

In addition to improving fraud detection and regularly monitoring online behavior, implementing behavioral biometrics can give banks several tangible benefits. Benefits of behavioral biometrics include:

- Frictionless User Experiences. Banks can provide a seamless user experience, enhancing customer satisfaction and trust. Customers don’t need to remember complex passwords or provide extra information, minimizing friction and improving convenience.

- Adaptive Risk-Based Review. Behavioral biometrics can adapt to different risk levels by analyzing user behavior in real-time. Detecting suspicious activity around a large money transfer can trigger additional security measures.

- Enhanced Loss Mitigation. Banks can use the technology to significantly reduce financial fraud losses by proactively taking measures. These measures may include blocking suspicious transactions, freezing accounts, or requesting additional verification. Taking these steps will customer assets and minimize the impact of fraud on both the bank and the customer.

- Improved Customer Trust. Trust is the foundation of a bank’s relationship with its customers. Behavioral biometrics offer customers a seamless and non-intrusive security process. Strengthening security with features like account protection creates a sense of security for customers, increasing their satisfaction.

Looking Ahead: The Future of Behavioral Biometrics

Behavioral biometrics holds great promise for the banking industry. By providing regular and non-intrusive authentication solutions, false positives drop and user experiences.

This technology could well become a key feature for banking security. We need to prioritize proper implementation and ethical guidelines. As fraud prevention professionals, it’s an exciting field to watch and one we’re incredibly proud to pioneer.

Resources for Behavioral Biometrics for Fraud Prevention and Detection

Here are additional resources for behavioral biometrics in fraud prevention and detection:

- Article: How Behavioral Biometrics Stops Family Fraud

- Resource: Risk & Reputation: Who Ultimately Pays for Scams?

- Solution Guide: Behavioral Biometrics Analysis

- Solution: Feedzai’s Digital Trust

Share this article:

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…