Financial crime is becoming increasingly complex, making criminal behavior harder to identify. Take for example the credit card fraud scam that resulted in twenty people pleading guilty: the group fabricated more than 7,000 false identities to obtain tens of thousands of credit cards. Or consider the money laundering ring that was recently caught by Europol in “Operation Tulipan Blanca:” 137 people were investigated and 174 bank accounts were used across multiple countries and currencies. When faced with such sophisticated coordination, what is a risk team to do?

The standard approach that most risk teams take is to review and assess transactions individually. Unfortunately, this approach has a fundamental flaw: because transactions are reviewed only when flagged by a risk system and on a one-by-one basis, investigators and data analysts only see a small piece of what is possibly a much larger picture. They may miss risky patterns such as multiple transfers being initiated by the same IP address in a high-risk country, leading to false negatives and financial crime losses. Or, they may misidentify legitimate patterns as criminal, such as family members using the same card to make many purchases at many stores, leading to false positives and damaged customer relationships.

Feedzai’s machine learning models and domain-specific rules do an excellent job of detecting anomalies and producing accurate risk scores. But risk scores are a form of data, and data can’t tell the entire story. Risk teams need a tool to detect emerging financial crime patterns before even the best data can. Feedzai Genome is precisely that tool.

How Feedzai Genome Helps Risk Teams

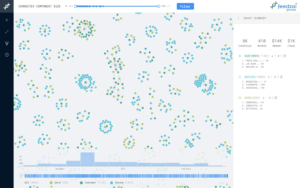

Feedzai Genome is a dynamic visualization engine that leverages Feedzai’s powerful AI technology and is completely integrated with our entire platform. It provides an intuitive way for investigators and data analysts to quickly identify emerging financial crime patterns because it improves the depth and efficiency of risk assessment.

Deeper Risk Assessment

Visualization surfaces the intricate connections among entities by showing investigators the hidden connections among transactions. It is an easy way to “follow the money”—investigators can simply click to expand details for transaction after transaction, instead of performing many manual searches and keeping track of results in a spreadsheet. This enables investigators to perform deeper, more accurate investigations. And by intuitively guiding investigators through relationships, Feedzai Genome helps them be confident in their decisions and explain them for compliance purposes.

Feedzai Genome also deepens risk assessment because patterns, not just flagged transactions, are reviewed, enabling investigators and data analysts to review more transactions overall. As a result, fewer false negatives slip through the cracks.

More Efficient Risk Assessment

Reviewing flagged transactions one-by-one is inefficient because capacity scales linearly with team size, and worldwide financial crime is growing much faster than risk teams can grow. Feedzai Genome helps risk teams scale capacity by displaying patterns, enabling teams to process transactions in groups instead of one by one. Plus, time-consuming and difficult tasks, such as manually uncovering the hidden relationships within a system, are done automatically by Feedzai Genome to enable straightforward entity resolution, automatically highlighting the most important connections.

As a visualization engine, Feedzai Genome is an especially effective way to catch complex financial crime because humans are naturally better at processing information from a visual than from a spreadsheet or report (this is often attributed to our ability to retain significantly more images simultaneously than words). A human can see that a cluster of transactions looks “off” before a machine learning model can learn, leading to earlier detection of new financial crime schemes. And through visualization, Feedzai Genome lets investigators and data analysts make decisions faster. An MIT study found that humans can identify images in as little as 13 milliseconds, whereas it often takes >200 milliseconds (or over 15 times as long) to derive meaning from text or numbers.

Our initial testing of Feedzai Genome is consistent with these findings and shows that it empowers risk teams to process alerts twice as quickly as before.

What Makes Feedzai Genome Different?

Powered by AI

Other visual link analysis tools tend to be fairly generic. While they may look good on the surface, they usually sit on top of simple AI approaches and their entity link analysis capabilities are basic at best. In contrast, Feedzai Genome works seamlessly with the entire Feedzai platform. By leveraging Feedzai’s world-class technology and omnidata ingestion, Feedzai Genome produces high quality alerts. This ensures that investigators and data analysts are focusing on the right issues, and are not wasting their time on unnecessary reviews.

Built to Fight Financial Crime

Like the rest of Feedzai, Feedzai Genome is purpose-built to fight financial crime. Feedzai has spent years researching and uncovering numerous financial crime typologies, and the result is a tool that has been honed to uncover only the most relevant connections.

Feedzai Genome also breaks down all of the transactions involved in the alert, allowing investigators and data analysts to understand the underlying genometry™ of financial crime. For example, Feedzai is very familiar with bot attacks. Feedzai Genome can identify criminal patterns, such as bot attacks, in real time, and generate alerts based on the score and shape of clusters.

Feedzai Genome also gets more accurate over time. The Feedzai platform enables Feedzai Genome to automatically find and surface similar patterns (account takeover schemes, mule account patterns, layering tactics, triangle schemes) learned from previous financial crime genometries™. The result is fewer false positives and negatives. Feedzai Genome also allows you to benefit from “active learning”—it’s an easy way for your data analysts to give feedback, so your model is trained online.

Adaptable to your Needs

Feedzai Genome is purpose-built to fight financial crime and can be adapted to any financial crime use case. Its flexibility allows it to be configured for all types of investigations—from looking for a CPC to tracing money laundering—in just a few clicks. While most other solutions require specific addons to be able to tackle more than one type of financial crime, Feedzai Genome can do it all.

Feedzai also recognizes the importance of data security and protection. As a result, Feedzai Genome is built to run any way you need it to. Whether it’s on-premise, on a private cloud or on Feedzai’s cloud, the power of Feedzai Genome can be leveraged.

How Risk Teams can use Feedzai Genome

Here are a few examples of specific financial crime genometries™ that risk teams can now find using Genome.

Identify and Manage Common Points of Compromise (CPC)

To detect a common point of compromise, investigators and data analysts can load transactions that are known to be fraudulent into the Feedzai Genome display, then add nodes to show the POS terminal, ATM, merchant, etc. where the transactions occurred. Feedzai Genome will show you if they occurred at the same place. Once you have identified the common point of compromise, you can create a node with the CPC at the center, surrounded by all the transactions that occurred at it, to identify the cards or accounts that are potentially at risk. Then, simply drag and drop to select all the at-risk cards or accounts and export them to a list for further investigation or action.

Identify Bot Attacks

Bot attacks are quite common, with bot traffic on the web surpassing traffic generated by humans in 2016. Yet, bot attacks can be difficult to detect because bots often disguise themselves as normal users, and because many bot attacks break themselves up into small clusters of transactions. Genome easily pinpoints these distributed attacks by linking smaller clusters and patterns through transitive link analysis or fuzzy matches to surface the hidden connections.

For more on how Feedzai Genome can be used to catch sophisticated fraud patterns, such as bot attacks, watch this demo.

Trace the Money Flow in Money Laundering Schemes

Financial institutions worldwide find it difficult to identify money laundering, particularly because money laundering schemes are often extremely sophisticated. Feedzai Genome can help stop money laundering before it starts by identifying risky relationships and preventing money launderers from opening accounts.

Feedzai Genome can also identify “layering.” Out of the three steps of money laundering—placement, layering, and integration—layering is the most complex. The main challenge with identifying layering is that it is meant to obscure the audit trail and sever the link with the original crime. It often involves many accounts and international money transfers, commonly using different currencies. Fortunately, Genome makes it easy to detect layering patterns by allowing users to easily see how each account relates to other entities and to identify connections between entities including individuals, accounts, and companies.

For more on how Feedzai Genome can be used to catch money laundering, watch this demo.

Staying Ahead

Feedzai’s core technology is built with three principles in mind: power, speed, and adaptability. Our goal is to constantly innovate to always stay ahead of financial crime. Feedzai Genome is a continuation of that goal and works in tandem with our other innovative developments, such as Feedzai OpenML and Feedzai AutoML, to support entire risk departments in their effort to fight financial crime.

Share this article:

Related Posts

0 Comments10 Minutes

Boost the ESG Social Pillar with Responsible AI

Tackling fraud and financial crime demands more than traditional methods; it requires the…

0 Comments8 Minutes

Enhancing AI Model Risk Governance with Feedzai

Artificial intelligence (AI) and machine learning are pivotal in helping banks and…

0 Comments14 Minutes

What Recent AI Regulation Proposals Get Right

In a groundbreaking development, 28 nations, led by the UK and joined by the US, EU, and…