Our Account Opening blog series sheds light on how banks can reduce friction to increase customer acquisition, assess risk efficiently with the help of machine learning, and combat financial crime in this era of increasingly complex fraud schemes and attacks. In our second installment, we’ll continue our conversation about the importance of building a workflow that meets applicants’ expectations, exploring why some banks are losing customers rather than gaining them.

There’s a direct correlation between application completion time and application abandonment; the longer it takes for someone to complete an application, the higher their chances of abandoning it. That goes for account opening application processes as well. Banks are always looking for ways to simplify the application process while mitigating risk and staying compliant. To illustrate this point, let’s follow the hypothetical journey of Lisa, an ideal customer, as she submits her application through two different account opening processes:

- one that has a tailored workflow (i.e., customized user journeys that trigger streamlined application processes based on applicants’ risk scores), and

- one that’s a traditional account opening process (i.e., a process without tailored workflows).

Let’s see how her journey unfolds and discover key learnings for how banks can acquire more customers and increase growth — all without increasing the risk of fraud.

Bank account opening: Customer application processes with tailored workflows versus traditional application processes

The traditional account opening process can be tedious for applicants, resulting in customer attrition. However, by adopting capabilities, such as rules and machine learning, customers are guided through tailored workflows based on their risk assessment. This enables banks to prevent fraud and reduce unnecessary friction by requiring step-up authentication only when needed. To see why, we need to first introduce (or reintroduce, if you read the first post in this series) you to Lisa.

Lisa is the owner of a contemporary two-story home in a trendy Silicon Valley neighborhood. She’s enjoyed a stable, flourishing career as an aerospace engineer for the past 21 years. With excellent credit scores hovering around the 760s, Lisa expects a quick and easy application process as a low-risk applicant.

Lisa completes two applications to open accounts through different banks. Let’s call them Bank A and Bank B.

Lisa completes two applications to open accounts through different banks. Let’s call them Bank A and Bank B.

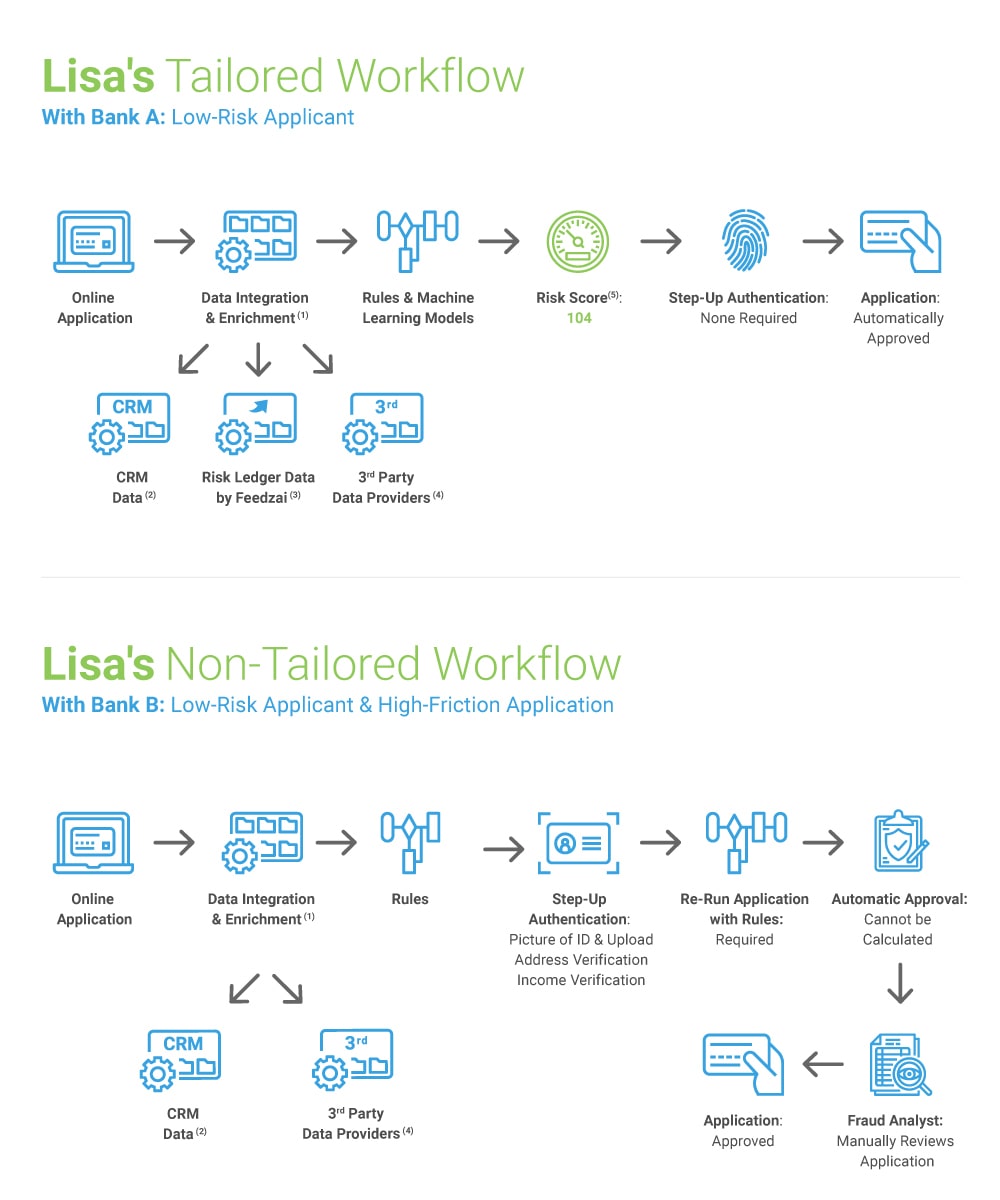

Bank A deploys an adaptive workflow that identifies low-risk applicants and recognizes them as ideal customers. Meanwhile, Bank B uses a “traditional” application process that doesn’t automatically recognize ideal, low-risk applicants. The journey Lisa undertakes for each account opening process contrasts drastically.

Let’s see how Lisa’s account opening journeys unfold:

(1) Data Integration & Enrichment: Application is enriched with additional data to obtain information about the applicant to verify their identity.

(2) CRM Data: Integrate with banks’ existing CRM data to better understand an applicant’s future behavior based on any existing accounts the applicant has with the bank.

(3) Risk Ledger Data by Feedzai: Utilize Feedzai’s cross-industry consortium data to gain a more thorough view of the customer.

(4) 3rd Party Data Providers: External calls are made to 3rd Party Data Providers to verify the applicant’s identity. (These can be credit score checks, documentation checks, email or address checks, etc.)

(5) Risk Score: Potential risk scores are calculated on a scale of 0 (low risk) to 1000 (high risk).

Key learnings for frictionless account opening

As you can see, Lisa underwent a significantly worse customer journey with Bank B, which used the traditional application process.

While Lisa was able to sit back, relax, and quickly complete Bank A’s application process, Bank B’s one-size-fits-all approach put her through step-up authentication to finish her application. This required income verification and a picture of her ID — steps that aren’t necessary for applicants like her to take.

Lisa was irked by Bank B’s process, especially when she compared it to Bank A’s frictionless account opening process. Bank B took a huge, unnecessary risk in applying the same level of scrutiny for all applicants. This risk frustrated Lisa, who is in their most valuable customer segment. She could have decided to abandon her application since application abandonment rates are closely tied to the amount of time and personal information it takes to complete an application. In short, Bank B’s outdated application process may have resulted in the loss of a customer, and one that would have brought good lifetime value at that.

On the other hand, Bank A’s account opening process succeeded in making a good first impression on Lisa. That’s because it used rules and machine learning, proactively tagged Lisa as a low-risk applicant, and guided her through a tailored workflow based on her risk level. In the end, Bank A was able to achieve what Bank B couldn’t: mitigating risk and giving Lisa the frictionless experience she expects.

Tailored workflows and their benefits

Tailored workflows based on real-time risk assessment provide a myriad of benefits. Chief among them is allowing high-value target applicants to provide only the minimal data required to complete the application. This reduces customer friction, increases conversion, and maximizes the lifetime value of the customer.

To remain competitive, minimizing account opening barriers and reducing friction for customers is a must, but retail banks should also remember that it’s necessary to reduce friction for themselves as well. Stay tuned to find out how banks can do just that.

Want to explore account opening in more depth? Download our new eBook, Account Opening: Fighting Fraud and Friction.

Share this article:

Related Posts

0 Comments6 Minutes

Latency in Machine Learning: What Fraud Prevention Leaders Need to Know

Latency is a critical factor in the performance of machine learning systems at financial…

0 Comments16 Minutes

How FIs Can Outsmart Bot Attacks

If life is like a box of chocolates, detecting bots is like baking a layered cake. Just…

0 Comments7 Minutes

Key Insights from the EBA’s 2024 Payment Fraud Report

The first European Banking Authority’s (EBA) 2024 Inaugural Report on Payment Fraud is a…