As if the battle against fraud wasn’t complicated enough, merchants have to contend with first-party fraud among their most valued assets: their own customers. Unlike second or even third-party fraud, first-party fraud involves consumers using their own payment credentials to create a dishonest act for personal gain. This leaves acquiring banks and payment service providers facing a complex challenge in helping merchants protect themselves.

Acquiring banks must thoroughly understand how first-party fraud works to help merchants tackle it effectively. Learn how acquirers and PSPs can help merchants defend against first-party fraud and safeguard their profits.

What is First-Party Fraud?

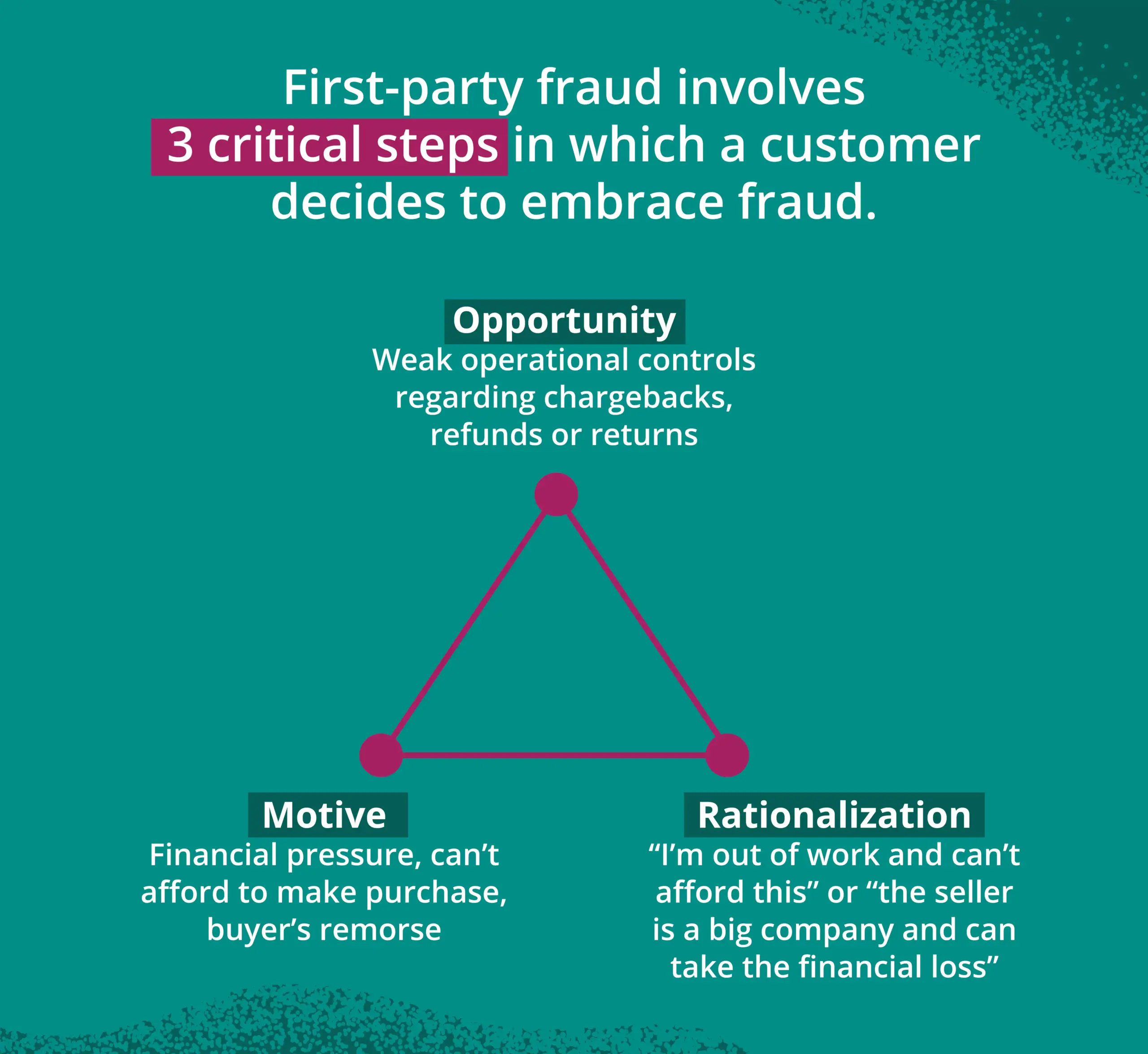

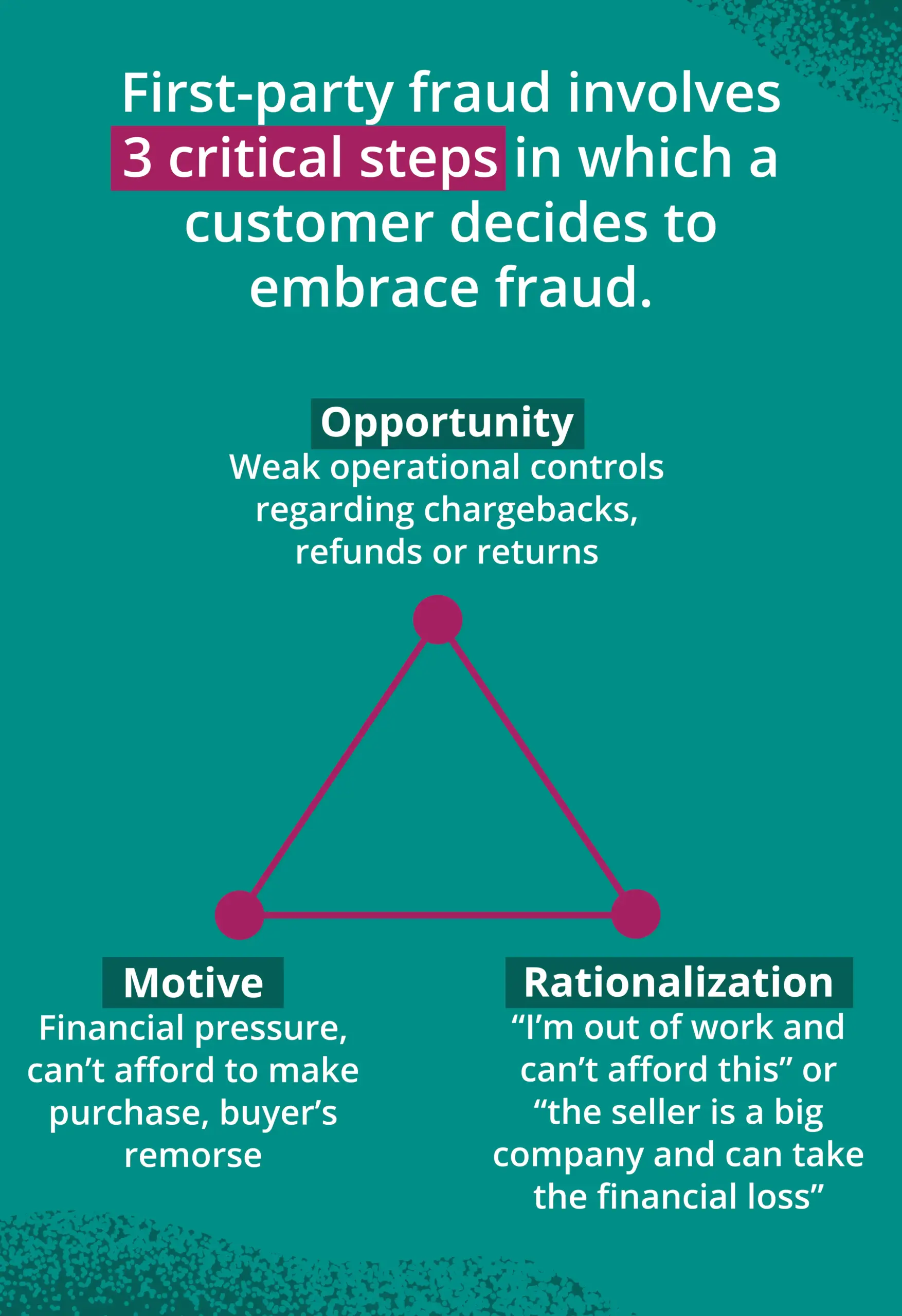

A consumer commits first-party fraud by knowingly defrauding a merchant for their own personal and financial gain. Ultimately, consumers receive goods or services from a merchant but never pay for them. Customers may decide to commit fraud for several reasons, which are covered below.

People also refer to first-party fraud as “friendly fraud” or “first-party misuse.” The Merchant Risk Council is advocating referring to such activities as first-party misuse as an industry standard.

The rationale for this adjustment is clear: there is nothing friendly about fraud. In time, the term “first-party misuse” is expected to gradually replace “friendly fraud” entirely.

First-party fraud (or first-party misuse) is when businesses realize that the problem is caused by someone within their own organization. Put another way, it’s when businesses realize “the call is coming from inside the house.” This legitimate relationship complicates merchants’ and financial institutions’ efforts in detecting and preventing first-party fraud activities because it originates from legitimate customers.

6 Common Types of First-Party Fraud

The most notable types of first-party fraud include:

1. Chargeback Fraud

Legitimate customers dispute legitimate transactions after receiving the purchased goods or services. They request refunds or chargebacks to the credit card from their financial institution, a loss the merchant ultimately has to absorb.

2. Buyers Remorse

In this form of first-party fraud, a customer makes a legitimate purchase. Then, for whatever reason, they regret the purchase and are no longer able to return the item(s) to the merchant. They request refunds or chargebacks from their financial institution. Once again, this is a loss the merchant ultimately has to absorb.

3. Family Fraud

This occurs when a junior member of a household makes purchases with a parent’s credit or debit card without the parent’s knowledge. A parent allows their child to use their phone for a game. Later, they notice many small charges on their statement for things bought within the game. The parent then disputes the transactions with their bank by raising a chargeback for transactions.

4. Return Fraud

When a customer places a legitimate transaction and then exploits the merchant’s return policy by returning used, stolen, or fake items in exchange for refunds or store credit.

5. Coupon/Discount Abuse

This is when customers exploit discounts and promotional offers to receive unauthorized discounts or benefits. Some bad actors (including legitimate customers) may exploit discounts for first-time customers by creating new profiles using different email addresses.

6. Unrecognized Transactions

This is where a genuine customer checks their bank statement and sees a transaction(s) they can not link back to their recent purchases. They then dispute the transaction with their bank, stating they never made the purchase. This often occurs when the billing description does not match the name of the store they have recently purchased items from or for subscription-based payments, often at the end of a free trial period.

3 Key Steps to Stop First-Party Fraud

Friendly fraud can be especially challenging to detect and prevent because (formerly) legitimate customers are behind them. Acquiring banks, PSPs and merchants are advised to take the following steps to minimize the risk of first-party fraud losses.

Chargeback Tracking and Monitoring

Merchants and acquiring banks can start by tracking chargeback activity.

If a customer made a chargeback for a purchase, watch their transaction history for similar transactions. Merchants should take special care to track and record chargeback activities to understand if this behavior is normal for the customer and whether or not it is suspicious.

By monitoring the history of chargeback transactions, or even refunds and customer returns, merchants can make informed decisions over whether to allow the customer to make new purchases. Merchants should invest in, or evolve, customer relationship management (CRM) data and fraud labels to monitor such situations effectively.

Help Merchants Connect to Card Networks

Acquiring banks are already well-connected with the card networks and have the ability to guide their merchants in adhering to card network rules. Acquirers should consider leveraging value-added services to help merchants compile compelling evidence for transaction disputes. For example, helping merchants connect directly to the card network solutions, such as Verifi and Ethoca provides a more automated way for handling chargebacks (or even preventing them) that arise from first-party misuse.

Use Accurate Billing Descriptions

While some individuals can deliberately commit first-party fraud, buyer confusion causes other instances. When a merchant’s billing description is unclear on a customer’s statement, the customer may not understand what they purchased. As a result, the customer disputes the charge. This might occur if the transaction shows the merchant’s official name or without mentioning any other name they use for business.

Acquiring banks can help merchants avoid such situations by managing their descriptions to align with card network regulations and guidelines. Using accurate and reflective descriptions, such as trading as (T/A) names on statements will help prevent confusion and disputes.

Acquiring banks need to actively engage with merchants, card networks, and technology solutions to enhance their first-party fraud prevention efforts. This includes their ability to prevent, detect, and address these activities.

Resources for First-Party Fraud Prevention

Share this article:

James Hunt

James Hunt has over 20 years of experience preventing payment fraud across banking, eCommerce, and payment service providers, specializing in creating, leading, and refining fraud prevention teams. Believing that fraud and risk teams should be an enabler of business and not a bottleneck, he’s consulted with some of the world's largest global brands. Prior to joining Feedzai, James held positions at NatWest, GoCardless, and Visa.

Related Posts

0 Comments6 Minutes

A Guide to Secure, Seamless User Authentication in Payments

Online payments demand a delicate balance between security and user experience. Consumers…

0 Comments7 Minutes

Combating Emerging Scams in the Philippines

The Philippines is witnessing remarkable growth in digital banking. Unfortunately, a…

0 Comments5 Minutes

Feedzai is a Leader in the 2024 IDC MarketScape for Enterprise Fraud Solutions

Exciting news! Feedzai, the world’s first RiskOps platform, is proud to have been named a…